The purpose of this analysis is to get a factual assessment the debt situation of the country

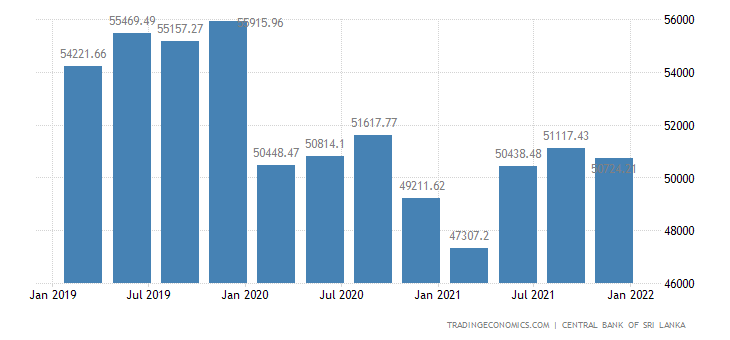

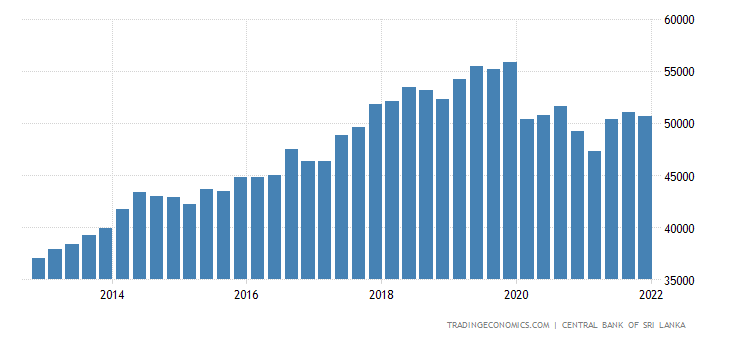

As per the information provided by Central Bank, the total debt of the country by last quarter of 2021 is USD 50.7bn. When current govt took office in 2019 the debt of the country was USD 56bn, highest ever debt burden recorded in the history of Sri Lanka1.

- https://tradingeconomics.com/sri-lanka/external- debt#:~:text=External%20Debt%20in%20Sri%20Lanka%20averaged%2047244.74%20USD%20Mi llion%20from,)

In spite of having to manage the COVID situation where country lost significant foreign income govt paid back 5bn in loans. Almost 10% of the inherited debt. In the last quarter of 2021, external debt of Sri Lanka came down to USD 50.7bn from USD 51.1bn in previous quarter.

At the time of Yahapalaynaya govt taking over in 2015, the total debt of the country was USD 44bn 2.

- https://tradingeconomics.com/sri-lanka/external- debt#:~:text=External%20Debt%20in%20Sri%20Lanka%20averaged%2047244.74%20USD%20Mi llion%20from,)

So in 5 years the Yahapalana govt clocked up borrowings of more than USD 12bn. In addition to borrowing this amount of money, when last MR government left they had USD 8bn in reserves, when Yahapalanaya handed back had only USD 7bn in reserves.

In addition to the said borrowings Yahapalanaya used up another USD 1bn for consumption purposes. Also they got another USD 1.12bn from the lease of the Hambatota Port to the Chinese. In fact, they have swallowed up close to USD 15bn during their term.

We have nothing to show for this USD 15bn except the good times enjoyed by the rich. Yahapalanaya claim the borrowings were made to pay off Debt of MR govt debt. At the time of handing over reins to Yahapalayanaya, SL enjoyed an annual growth of nearly 7%. When they handed back the growth was only 2.5%.

The next ISB payment due is in June/July this year, which was a borrowing made June 20123 , after that no borrowing has been made till Jun 2015.

So all remaining ISB payments amounting USD 12bn are for the borrowings by Yahapalanaya since Jun 2015. This is USD 12bn is nearly 20% of Sri Lanka Debt. The current govt has paid back 10% of debt it inherited. Compare this performance with adding 27% to the debt by Yahapalanaya, which they inherited. Sadly, the man trying to pay the debt becomes villain and the those borrowing for consumption becomes heroes.

Now, paying the debt off was good but not giving consideration to people’s urgent needs was bad. True but can we spend money we don’t earn is the question?