රතන සූත්රය

ශ්රී වජ්රඥාන චරිතය

Dollar crisis poses existential threat to Sri Lana’s publishing industry: authors

ECONOMYNEXT – Sri Lanka’s prevailing dollar shortage is severely impacting the country’s publishing industry which may grind to a halt in March as a result of price hikes and shortages in imported paper and printing materials, a collective of authors said.

Speaking at a press conference organised by Mass Guiding Artists, a collective affiliated with the opposition National People’s Power (NPP), writer Kamal Perera said on Thursday (10) that thousands of jobs in the industry are now in danger as a result of Sri Lanka’s economic crisis.

“There is no paper in the market. There are no dollars to import paper.

“In three months, the price of a ream of paper has gone up by 900 rupees. A ream cost about 5,200 rupees in December; it is now difficult to find one in the market even for 6,200 rupees,” said Perera.

Sri Lanka is currently going through one of the worst economic crises in its history, compounded by a severe dollar shortage and rising inflation that some economists have blamed on excess money printing.

According to the writer, there is also a shortage in plates and other equipment used in printing.

He complained that the government is not interested in finding solutions and doesn’t seem to consider the emerging crisis in the industry to be a serious matter.

“The government has no interest in this whatsoever. It is not in the interest of corrupt leaders to have a learned populace,” said Perera.

He called for slashed taxes and other measures to save the industry.

“In former Prime Minister Sirimavo Bandaranaike’s time, there was a quota for writers and publishers. They can remove taxes for imported paper. Alternately, they can produce paper locally. There are several factories in our country, but they don’t manufacture paper for book printing,” said Perera.

Perera expressed suspicion that the apparent lack of interest on the part of the authorities could be an attempt to outsource book printing to a foreign country.

“We wonder if a proposal will be made that we outsource printing to China, which is a nation that’s very friendly to this government and is a global leader in printing. Or even to Singapore or India,” he said. (Colombo/Feb11/2022)

Sri Lanka ruling party blames crises on external forces, promises prosperity

ECONOMYNEXT – The ruling Sri Lanka Podujana Peramuna (SLPP,) in a high profile campaign rally held in Anuradhapura on Wednesday (09), blamed the pandemic and the opposition for the multiple crises the country is currently grappling with, leaving key issues and alleged policy blunders largely unaddressed.

Speaking at the rally, a seemingly defiant President Gotabaya Rajapaksa claimed that his administration has won back the country’s lost sovereignty and heritage, and invited the public to place their trust in the increasingly unpopular government to deliver on its promises in the remaining three years of its term.

“We come before you having actually done the work. I ask you to join us – join me – and place your trust [in us],” Rajapaksa told what appeared to be a large crowd of party supporters gathered at the Salgadu Public Ground in Anuradhapura.

“In these difficult times, we have afforded you every relief on every occasion. Going forward, as we take these policies ahead, I pledge to you that we will fully implement the Vistas of Prosperity and Splendour that we promised, in the next three years,” he said, to tumultuous applause.

In his uncharacteristically uproarious speech, Rajapaka also promised to increase the income of Sri Lanka’s farmers by 100 percent, though he did not elaborate. Farmers in Anuradhapura and elsewhere have taken to the streets in furious protest of the government’s highly controversial organic fertilizer policy.

“We gave you the fertilizer you needed; we gave you the guaranteed price you wanted. Today you can sell it for 95 rupees. I guarantee to you that I’m committed to doing anything for the farming community,” the president said, noting that his vision for a green economy was aimed at protecting Sri Lanka’s farmers from deadly disease. He also claimed that vested interests, both local and foreign, are actively working towards disrupting the government’s efforts in this regard.

Criticising the previous government, Rajapaksa claimed that then President Mahinda Rajapaksa was robbed of a third term at a time when he, having “saved the country from terrorism”, was engaged in economic development.

“What happened during those five years [of the Yahapalana government]? The security that we had guaranteed was destroyed, which culminated the Easter bombings. The intelligence units were destroyed. War heroes were betrayed. They went to the international community and destroyed this country’s sovereignty. Our nationality and religion were destroyed.

“Buddhist monks were taken to court. Our religion and culture… Look how today Kuragala, the Muhudu Maha Viharaya, and Digavapiya, have once again become our heritage,” he said.

The Rajapaksa administration has faced harsh criticism from Sri Lanka’s Catholic leadership over its alleged unwillingness to bring justice to the 269 victims of the 2019 Easter bombings, with Archbishop of Colombo Malcolm Cardinal Ranjith vowing to take the matter up with the international community. The SLPP has also been met with criticism, particularly by civil society, over its singular emphasis on concerns of the Sinhala Buddhist majority, which critics say is politically motivated.

Meanwhile, Prime Minister Mahinda Rajapaksa, who also addressed the gathering, said the SLPP planned to start a new journey from Anuradhapura, the site of previous public rallies that he said had propelled the party to electoral success.

“Every fight we won was started here. Today we start such a journey from Anuradhapura.

“For two years we battled this COVID-19 pandemic. That entire period, we were focused on saving the people from this epidemic,” said the prime minister, questioning the opposition’s criticism of the government’s handling of the epidemic. He accused the opposition of creating doubts among the public over the efficacy of the Chinese-made Sinopharm vaccine – the country’s most widely used COVID-19 jab yet.

“They were able to play around like this because we silently carried out our work while protecting the people. The longer we stay quiet, the harder they try to create chaos in the country,” he said.

PM Rajapaksa also touched on the fertilizer issue, though he stopped short of admitting that the timing of the policy was questionable.

“You know what the farmer’s issue is. (Audience shouts in support). Yes, yes, we know (laughs). We all know, because we too come from farming,” he said.

Rajapaksa blamed the United National Party (UNP), despite governing for decades, were unable to pay the farmers enough in 2015.

“Remember how farmers drank poison because there was no price [guarantee]? The people shouting now, were they there to check on the farmers then? No.

“But what has happened today? The opposition is now shouting everywhere that this government is the sworn enemy of the farmer,” said Rajapaksa.

Issuing a warning to the opposition, the premier said: “They must remember that we too are very used to the streets. We’re used to going on Paada Yathras. We too will come to the street now.”

Among other government ministers who spoke at the rally, State Minister Channa Jayasuma too blamed the country’s economic crisis – one of the worst in its history – on the pandemic.

“We were handed a country with a destroyed economy and society. Just when we were getting ready to start correcting the wrongs made from 2015 to 2019, the whole world was struck by the pandemic. The whole world is at an economic crisis, and a small country like ours cannot bear up,” said Jayasumana.

“COVID is the real reason we couldn’t reshape this ravaged country, and if anyone says otherwise, I think they will need to get their brains checked,” he added.

Meanwhile, Minister of Energy Udaya Gammanpila tweeted earlier on Wednesday that, “entire world was gulped by #Corona. Only few countries are faced with foreign currency scarcity. If #Corona is d cause for d present crisis, entire world should have faced the similar situations. Our economic crisis was caused by the debt burden and aggravated by #Corona.”

https://twitter.com/UPGammanpila/status/1491263594289561601?s=20&t=pT975hdPmocVHGhUWXz1rQ

The factors that experts say led to the current forex crisis , compounded by excess money printing and inflation, was hardly addressed. Jayasumana said the country relied on migrant workers, exports, and tourism to bring in foreign currency.

Although Sri Lankan tourism is on a slow rise, experts say that it will not help solve the forex crisis. Lack of dollars in the country has resulted in several containers worth of essential goods remaining stuck at the Colombo Port, with no dollars to release them.

The party also made several remarks about the country’s “excellent vaccination process.” Transport Minister Pavithra Wanniarachchi said: “Mahinda Rajapaksha won one war for the country. We have won over the pandemic, and Minister Basil Rajapaksha will triumph over the economic war that we are now facing.”

Wanniarachchi, who was Health Minister during the first two waves of the epidemic, also mentioned that the country was on the cusp of “breathing freely” as the pandemic was nearing its end. The government’s own health officials, however, warn that the Omicron variant is on the rise in Sri Lanka, leading to an increase in daily cases.

Several speakers alleged that the opposition had made remarks about the safety of the vaccines that were imported, and caused fear among the population.

“We are among the top ten countries in the world when it comes to vaccine rollouts,” claimed Minister Kanchana Wijesuriya. International reports suggest otherwise, but experts agree that, despite some initial delays, Sri Lanka’s vaccine drive has indeed been commendable.

https://www.nytimes.com/interactive/2021/world/covid-vaccinations-tracker.html

https://edition.cnn.com/interactive/2021/health/global-covid-vaccinations/

However, few speakers offered workable solutions to the crises the country is engulfed with, though many made loud proclamations of faith that the Rajapaksa trio – namely the president, prime minister and Finance Minister Basil Rajapaka – would soon lead the country into the new era promised in 2019. (Colombo/Feb09/2022)

Sri Lanka spends US$736mn to defend 200 to dollar peg as...

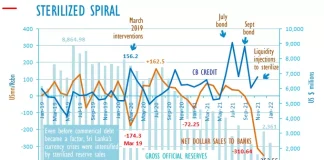

ECONOMYNEXT – Sri Lanka’s foreign reserves sales to commercial banks defend a 200 to the US dollar peg soared to 736 million dollars from September to November 2021 official data shows, forcing money to be printed to maintain a fixed policy interest rate.

In November and December alone 664 million dollars of reserves were sold to commercial banks.

The injection of money after such ‘reserves for imports’ to defend a peg (sterilization of interventions) prevents the contraction of reserve money, prevents a rise in short term interest rates, prevents a required slowdown in private credit and re-ignites demand for imports.

In a remarkable descent in to Mercantilist ideology, calls were made in Sri Lanka to spend more reserves on imports while simultaneously claims were made that a 200 to the US dollar peg was unsustainable.

Related

Sri Lanka use of reserves for imports is a deadly false choice: Bellwether

Why Sri Lanka’s rupee is depreciating creating currency crises: Bellwether

Any reserve sales for imports is a defence of the peg, which commits a central bank with a fixed policy rate to print more money through ‘open market operations’, triggering yet more imports.

If reserves are used for imports without allowing the monetary base to fall, sovereign as well as private foreign debt default may become inevitable even if debt is re-structured, analysts have warned.

The injection of money after giving reserves for imports is the hallmark of a soft or unstable peg (now called a ‘flexible’ exchange rate), that trigger currency crises and balance of payments deficits.

A clean float (suspension of convertibility) is required to stop the cycle of sterilized interventions.

Sri Lanka required structurally higher interest rates as soon as the country was locked out of bond markets in 2020 to generate resources to repay debt. However rates were cut in 2020 amid downgrades.

Sri Lanka’s market rates have risen after yield controls were lifted, though mostly three month bills are being bought, and deficit monetization is minimal.

In sterilizing reserves for imports, liquidity is injected into commercial banks (private sector) but to later observers it appears as deficit finance, since money is printed not against private securities but government debt.

For centuries, during the gold standard era, the Bank of England used to operate its discount rate (which was not fixed) against private debt (bankers’ acceptances) which were tradable in the secondary market.

Open market operations as known today was invented by the Federal Reserve in the course of firing the ‘Roaring 20s’ bubble that led to the Great Depression. A part of the bubble involved firing up stocks with margin credit.

In the way Sri Lanka’s central bank engages in reserve sales for debt repayments against newly created Treasury bills it is possible to appropriate reserve for debt repayment without changing rupee reserves in individual banks through a series of back-to-back transactions (no reserve pass-through).

Sri Lanka created a soft-peg in 1950 ending floating short term rates and a fixed exchange rate that had protected the population from a Great Depression and two World Wars. Sri Lanka has reserves worth 11 months of imports when the soft – peg was created.

The UK around the time was facing severe currency troubles due to Keynesianism.

In November the central bank sold 310 million US dollars to commercial banks on a net basis which rose to 353 million US dollars by December.

The interventions are the highest seen since the 2018 currency crisis.

Sri Lanka’s past currency crises up to around 2005, which sent the rupee careening down from 4.70 to the US dollar to around 110 were intensified with sterilized reserve sales to defend a peg, though the crisis may have been initially triggered by budget finance or rural credit.

Amid more discretionary and contradictory monetary policy after the end of a 30-year war, involving a ‘flexible’ exchange rate and ‘flexible’ inflation targeting Sri Lanka has faced currency crises and depreciation in quick succession and the rupee is now at 200 to the US dollar.

Parallel exchange rates are around 248 to the US dollar.

The central bank has also imposed surrender requirement for exporter and remittance dollars, despite the peg being weak and requiring tighter monetary policy. A surrender requirement pushes the currency down through liquidity creation. A reserve sale can strengthen the currency as long as it is not sterilized.

In the nine months to September the central bank bought 228 million dollars on a net basis from commercial banks under a surrender requirement despite a peg having already weakened. (Colombo/Feb08/2022 – Update II)

Sri Lanka ruling party gears up for local govt polls amid...

ECONOMYNEXT – The ruling Sri Lanka Podujana Peramuna (SLPP) in a bid to test the pulse of people, possibly via local government polls, is holding its first campaign rally in the ancient city of Anuradhapura amid growing public frustration over government policies.

The rally is taking place despite heightened fears of a COVID-19 resurgence and also at a time when SLPP legislators openly complain about public protests that greet them when they visit their constituencies. The government’s popularity has taken a hit thanks to, among other things, rising inflation and the highly controversial organic fertilizer policy which experts have warned could result in a food shortage.

People across the country have publicly criticized President Gotabaya Rajapaksa and his key ministers, accusing the SLPP-led coalition of bringing back the “era of queues” of the 1970s. Critics also claim that price ceilings imposed by the government have created a raft of commodity shortages on top of an acute foreign exchange shortage.

“We start our campaign rally on February 09 in Anuradhapura,” Finance Minister Basil Rajapaksa told a media briefing last week when he was asked about the government’s plan to hold elections.

“That’s our first meeting. That’s a public meeting. Then we will have our women’s conventions over the next two weekends,” he said, adding that the SLPP has so far scheduled meetings to be held in five provinces in the near future.

“We had to follow the health guidelines and thus had to temporarily we had give less priority to political activity. We cannot do that anymore. So we are starting the meetings with the public.”

The SLPP-led coalition’s first rally comes after the government announced a 40-billion-rupee (USD 200 million) compensation scheme for farmers hit by the inorganic fertilizer ban.

It also announced a 229 billion rupee (around USD 1.3 billion) relief package targeting government servants, pensioners, farmers, many of whom are rural folk, political analysts say.

Grassroots level farmer organisations have said the paddy production in the Maha cultivation season was expected to have dropped by around 50 percent due to the government’s failure in providing the required fertilizer on time.

However, Agriculture Minister Mahndanada Aluthgamage has said the drop would only be 10 percent.

Growing dissatisfaction

President Rajapaksa was expected to execute policies that were not implemented by any of his predecessors since the country gained independence from the British colonial rulers.

However, a majority of his tenure in the top office was hit by the COVID-19 pandemic, which the government has said was the main reason for the host of issues the country is currently facing.

However, political analysts say the country is in difficulties due to ad hoc policies that were formulated by a handful of people without consulting all stakeholders.

“Despite the fact that the current crisis could be overcome by far-sighted policies, the government is engaged in pursuing a stupid and destructive policy that leads to exacerbate the crisis and maximise the damage to the country and the people,” Victor Ivan, a political analyst and former Editor of the Ravaya newspaper, wrote in his weekly column on the privately run Daily FT newspaper.

“The government’s policy on the use of fertilizer is one example that can be cited in this connection. The government has created an unprecedented major crisis in agriculture by imposing a ban on import of chemical fertilizers and other chemical inputs used in agriculture.

“The country is being pushed to a point where even rice, which can be considered the staple food, has to be imported. Obviously, there is a real danger of the country facing a severe food shortage and famine,” wrote Ivan.

Opposition parties have said the ban on agro-chemicals, the promotion of a miracle concoction as a precautionary measure for COVID-19 while delaying vaccines, setting price ceilings for rice, sugar, and milk powder that have now resulted queues across the country, and an import ban while keeping interest rates at record low levels show the government’s carelessness when formulating policy.

A fuel shortage that has now resulted in announced and unannounced power cuts has also damaged the current government’s popularity not only among the urban middle class families, butthe rural population who are primarily dependent on cultivation for their livelihood.

Meanwhile, agitation by Catholics over a delay in justice for the 2019 Easter Sunday attacks has also brought into question the government’s credibility, analysts say. The Catholic leadership in Sri Lanka has said it will seek international assistance for justice amid raising doubts over the local probe.

Economic woes

Several policies also hit the import-export trade as Sri Lanka’s forex shortage led to an import ban which has in turn made importers buy dollars from other sources as they are unable to open letters of credits in local banks.

Parallel exchange rates range from 240 to 260 to the US dollar.

In addition to these crises, the government has also failed to address endless demands by trade unions, which has resulted in daily protests inconveniencing thousands.

There are growing calls to go the International Monetary Fund to get comprehensive economic program as amid protests.

Both opposition center-right Samagi Jana Balawegaya and the Marxist Janatha Vimukthi Peremuna (JVP) have demanded an election to test the government’s popularity. The parties have been busy organising their own grassroots level political activities.

A determined Finance Minister Basil Rajapaksa, who is the strategist of the SLPP, said he wants to go for an election sooner rather than later.

“I have a plan to go for elections soon,” the minister said last week.

“We can only go with the existing [election] system. The only election we can hold is this [local government polls],” he said.

“Legally you can’t hold the presidential polls. You can’t hold the parliament polls until two and half a years. The last government had enacted legislation in such a way that we can’t hold the provincial elections soon. We need to make great effort to change it.”

Sources in the ruling party believe that Sri Lanka’s scattered opposition which are still not ready for an election, and the government’s compensation and relief packages could be used as advantages to rally around a new leader aiming for the 2024 presidential polls. (Colombo/Feb09/2022)

Sri Lanka seeks to shine as tourist wedding destination

ECONOMYNEXT – Sri Lanka’s tourist industry, designers and wedding services providers are teaming up to promote destination weddings in the island as tourism revives from the shock of a Coronavirus pandemic.

“We have already made a name as a wedding destination in many markets such as European, Asian and even the middle east,” Kimarli Fernando, Chairperson of Sri Lanka Tourism Development told reporters.

“We as an industry need to work to together to build relationships with our peers perhaps in India, Nepal, Maldives and Pakistan and promote weddings.”

Before the Coronavirus crisis Sri Lanka’s hotels has seen modest weddings by young Western couples and large parties thrown by parents of Indian couples where entire floors of hotels were hired for days at a time.

Fernando says Sri Lanka has a lot of potential in wedding segment and a variety of places where weddings can take place – near Singharaja forest, cultural triangle, on beaches and in Yachts.

Therefore, the authority is gearing to open a separate wedding portal for this purpose that would include all the necessary businesses to host a wedding in the country.

“Sri Lanka Tourism will open a separate wedding tourism portal to promote weddings for everybody,” Fernando said.

“We will provide the event management companies, wedding planners, photographers and, so that anybody could look at it and reach out to the relevant businesses.

“Sri Lanka is everything that Asia has to offer.”

SLTDA in partnership, with Brides of Sri Lanka, a bridal magazine, Galle Face Hotels and SriLankan Airlines is hosting a two day wedding exhibition on February 19 and 20 to promote the idea.

‘Wedding Week 2022; will be a free of charge exhibition that will have Indian and Maldivian fashion designers presenting along with local designers as well as support services.

“Weddings is one of the significantsegment for the hotel and a significant revenue stream for Colombo and Sri Lanka,” Daniel Grua, General Manager of Galle Face Hotel, Sri Lanka said.

“And Sri Lanka is one of the most sought after destinations in the world for the beauty and hospitality it offers.”

Grua said Sri Lanka’s industry is earns roughly 150 to 200 million dollars annually while supporting 130,000 jobs according to some estimates.

He also said that at least 25 percent of the weddings overall are destination based accounting for 25.1 billion dollars annually.

Sri Lanka is targeting 1.1 million tourist this year.

Fernando said they are getting the month and daily numbers to achieve the targets.

Last month, on average per day Sri Lankahas received 3500 tourist.

She said in 2018 they received about 6000 arrivals per day and their target is to get 50 percent of that.

“There is a worry about the infections, but we are confident on Sri Lankas vaccination drive with the on-going booster,” Fernando added.

“More importantly Wedding tourism and mice is two areas we are focusing on.”

(Colombo/Feb08/2022)

Sri Lanka shares fall to near 6-week low on new tax...

ECONOMYNEXT – Sri Lanka’s stock market slipped on Tuesday (08) to its lowest in 2022 on a government proposal to impose a 25 percent surcharge on groups, companies and partnerships amid concerns over a looming economic crisis, brokers said.

Sri Lanka will charge a 25 percent windfall tax in the style of a ‘super gains tax’ started by the last administration on groups of companies, companies, partnerships and individuals earning over 2.0 billion rupees, according to a draft law gazetted.

The main All Share Price Index (ASPI) fell 1.97 percent or 249.22 points to close at 12,382.69 points, its lowest since December 31.

“The market, in general, is going through a correction at the moment. However, today the announcement of the 25 percent surcharge came into play,” a top market analyst said.

“Even though this was priced in before, the surcharge applicable for the group came as a surprise to the investors. This has got people thinking about corporate profits and so on.”

Large caps like Expolanka and LOLC have dragged the index down in the past few days.

“Even before the earnings came, the share prices shot up with the anticipation of good earnings so now share prices are adjusting down. Fundamentally nothing has changed. The big thing everyone was expecting from Expo was the earnings so now that it is out, investors have nothing new to expect,” the analyst added.

“Now the question investors have in mind is how sustainable are these earnings going to be because of the forex crisis most companies are going through.”

S&P SL20 of the more liquid index fell 2.61 percent or 111.52 points to 4,165.60.

There are also predictions of the central bank allowing the market interest rates to rise to defend the currency and curb inflation.

Foreign investors, who are highly worried about possible sharp depreciation or devaluation in the currency, bucked the trend and bought a net of 59.4 million rupees. The foreign sales so far this year has been 3.4 billion rupees. In 2021, the Sri Lanka stock market suffered a net foreign outflow of 50 billion rupees.

Analysts had predicted that the economic concerns would drag the market from time to time until the government finds a sustainable solution for the country’s looming debt crisis.

The island nation’s foreign reserves fell 25 percent to 2.36 billion US dollars by end January, the central bank’s latest data showed. That reserves include a 1.5 billion US dollar swap from China and 400 million US dollar swap from India.

The island nation repaid a 500 million US dollar loan on January 18 to avoid a sovereign debt default, but persisting forex shortage has weighed on the country’s oil imports and led to power cuts. The government is struggling to avoid continuous power cuts amid announced and unannounced power cuts across the country.

The day’s turnover was 5.4 billion rupees, less than this year’s daily average of 7.7 billion rupees. And a two-week low.

Analysts said investors are worried about possible currency depreciation, the government’s ability to avert a sovereign debt default, and fuel shortages hitting factory manufacturing and thus hitting future earnings.

Expolanka, LOLC Holdings and Royal Ceramics Lanka dragged the index down on Tuesday.

Expolanka, the market heavyweight which has export and freight businesses, lost 5.36 percent to close at 317.75 rupees. The firm reported a staggering four-fold earning of 23 billion rupees in the December 2021 quarter compared to a year earlier, pushed by higher freight rates and recovery of sales to North American and European markets.

LOLC Holdings slipped 3.71 percent to 1,109.00 rupees a share, while Royal Ceramics fell 5.92 percent to 68.30 rupees a share.(Colombo/Feb08/2022)

Sri Lanka India in ‘strategic partnership’ says FM amid emergency financing

ECONOMYNEXT – Relations between Sri Lanka and India have improved into a strategic partnership from a transactional relationship Foreign Minister G L Pieris as New Delhi is bankrolling the island to the tune of 2.4 billion US dollars amid a balance of payments crisis.

During the visit, Foreign Minister Peiris met with his counterpart Jaishankar and the National Security Advisor of India Shri Ajit Doval. Indian Foreign Secretary Shri Harsh Vardhan Shringla also called on the Foreign Minister.

“The relationship between India and Sri Lanka has evolved from a transactional relationship into a strategic partnership which is increasingly recognized by the people of Sri Lanka that India is a true friend whom Sri Lanka can rely on at all times.

Minister Peiris appreciated the financial assistance that the Government of India has extended to Sri Lanka to the tune of 2.4 billion dollars.

Sri Lanka is in the middle of a severe currency crisis after money was printed to suppress rates in a bid to create a ‘production’ economy backed by import controls.

Minister Pieris had discussed economic cooperation, power and energy cooperation, connectivity and tourism and said a recent agreement on oil tanks in Trincomallee showed closer integration between the two countries.

The prospects for renewable energy cooperation, particularly in wind and solar power sectors were also discussed at the talks.

Sri Lanka stock index falls on economic concerns amid foreign selling

ECONOMYNEXT – Sri Lanka’s stock market closed weaker on Monday (07) dampened by economic woes and a looming debt crisis, brokers said.

The main All Share Price Index (ASPI) fell 1.03 percent or 130.91 points to close at 12,631.69 points.

“Investors expect the central bank will allow the market interest rates to rise to defend the currency and curb inflation,” an analyst said.

“The excess money printing has caused the pressure on the exchange rate and the central bank has to increase the rates if it wants to defend the currency at the current level.”

First Capital Market Research said in a note that the index skid as ambiguous investors resorted to book profits in selected counters over rising uncertainties in the economy.

S&P SL20 of the more liquid index down 1.22 percent or 52.90 points to 4,280.86.

Foreign investors, who are highly worried about possible sharp depreciation or devaluation in the currency, sold a net of 457.1 million rupees. The foreign sales so far this year has been 3.4 billion rupees. In 2021, the Sri Lanka stock market suffered a net foreign outflow of 50 billion rupees.

Analysts had predicted that the economic concerns would drag the market from time to time until the government finds a sustainable solution for the country’s looming debt crisis.

The island nation’s foreign reserves fell 25 percent to 2.36 billion US dollars by end January, the central bank’s latest data showed. That reserves include a 1.5 billion US dollar swap from China and 400 million US dollar swap from India.

The island nation repaid a 500 million US dollar loan on January 18 to avoid a sovereign debt default, but persisting forex shortage has weighed on the country’s oil imports and led to power cuts. The government is struggling to avoid continuous power cuts amid announced and unannounced power cuts across the country.

The day’s turnover was 6 billion rupees, less than this year’s daily average of 7.9 billion rupees. And a two-week low.

Investor sentiment has turned negative amid record-high inflation, depreciation pressure on the rupee, central bank’s excess printing money and the government’s failure to take sustainable action to deal with the debt crisis.

Analysts said investors are worried about possible currency depreciation, the government’s ability to avert a sovereign debt default, and fuel shortages hitting factory manufacturing and thus hitting future earnings.

Expolanka, LOLC Holdings and Browns Investment dragged the index down on Monday.

Expolanka, the market heavyweight which has export and freight businesses, plunged 2.75 percent to close at 335.75 rupees. The firm reported a staggering four-fold earning of 23 billion rupees in the December 2021 quarter compared to a year earlier, pushed by higher freight rates and recovery of sales to North American and European markets.

LOLC Holdings fell down 2.54 percent to 1,151.75 rupees a share, while Browns Investment slipped 3.23 percent to 15.00 rupees a share. (Colombo/Feb07/2022)