Sri Lanka foreign reserves drop to US$1.8bn in April

ECONOMYNEXT – Sri Lanka’s gross official reserves have dropped 90 million US dollars to 1,827 million US dollars in April 2022, official data showed, with an attempt to shift from a soft-pegged exchange rate to a float still not having succeeded.

Finance Minister Ali Sabry told parliament that useful reserves were down to 50 million US dollars.

Most of the remaining reserves are from an 11 billion Chinese Yuan swap (about 1.5 billion US dollars) obtained through a swap which has restricted use.

The central bank said there were 1,827 million dollars of currency reserves, down from 1,917 million dollars.

There was 115 million dollars in IMFs special drawing rights, 29 million US dollars in gold, unchanged.

Sri Lanka started to experience unusual monetary instability after the end of a 30 year war with discretionary policy involving flexible inflation targeting (printing money to push inflation up when the credit system recovers from the last currency crisis of the soft-peg).

There can be no currency crises without a peg.

It was coupled with output gap targeting (printing money to push growth after the credit system recovers from the last collapsed of the soft-peg).

To calculate the output gap and give clues to trigger happy interventionists to print money the International Monetary Fund gave technical assistance to calculate an output gap.

In 2018 the central bank printed money and created a currency crisis despite tax hikes and a fuel price formula and triggered a currency crisis showing that under flexible inflation targeting/output gap targeting no amount of fiscal fixes will bring results.

Foreign borrowings ratcheted up at both central government and also Ceylon Petroleum Corporation as output gap targeting created forex shortages, making it difficult to pay for oil or repay debt through the purchase of dollars.

In 2020 taxes were also cut saying there was ‘persistent output gap’ and the central bank also borrowed abroad as money printing led to forex reserve losses and the CPC and the Central government could not borrow. (Colombo/May08/2022)

Sri Lanka President declared emergency to ensure political stability – Info...

ECONOMYNEXT – Sri Lanka president’s decision to declare the State of Emergency was to “ensure political stability” and thereby assuring public safety and uninterrupted supply of essential services, the government said on Saturday.

President Gotabaya Rajapaksa declared the emergency law for the second time in five weeks amid the public uproar against his mismanagement of economic policies and increasing demand for him to resign. He has defied the calls and said he did not create any economic crisis.

“Sri Lanka is currently facing the worst economic crisis and political instability ever after

Independence due to manifold reasons both short and long term,” the government’s Information Department said in a statement.

It said the recent protests by the people including trade unions have interrupted essential services including the distribution of fuel, crippled public transport including the railway service, and disrupted daily functions of hospitals thereby causing inconveniences to the patients.

The protests also have disturbed the operation of manufacturing industries including the Apparel sector, school students, the attendance of workers attached to both the state and private sector factories while disrupting the day to day life and thus deepening the economic crisis.

“Therefore, with the intention of ensuring public safety, continuing the supply of essential goods and services uninterruptedly, and ensuring smooth public transport; according to the powers vested in the President under the Public Security Ordinance, Emergency Regulations have been declared,” the Information Department said.

“The State of Emergency was imposed as a short term measure of easing the crisis, and it will be lifted immediately after normalcy returns to the island.”

Thousands of Sri Lankans have started street protests against the government’s failure demanding the continuous supply for essentials such as medicines, fuel, cooking gas, and milk powder as well as uninterrupted power supply.

The 84.5 billion US dollar economy has already suspended foreign debt repayments as it has run out of foreign currency reserves.

The protests also come as the island nation is facing its worst food crisis after the President’s overnight decision to ban chemical fertilizers had hit the harvest across the country.

President Rajapaksa last month said banning fertilizer and delayed decision to seek assistance from the International Monetary Fund (IMF) were “mistakes”, while finance minister Ali Sabry last week said a 2019 tax slash was a historic mistake.

Most youth-led protesters say President Rajapaksa was responsible for the current crisis which has now aggravated with over 80 percent depreciation in the rupee currency in two months as he was either indecisive or delaying crucial decisions.

The Information Department in its statement said the most urgent challenge before the country is to manage the economic and debt crises within the shortest period of time.

“Discussions have already been opened with the multi- lateral institutions led by the IMF and friendly countries to obtain financial assistance, and restructure outstanding debt, and the outcome of such discussions are positive.” it said. (Colombo/May08/2022)

Sri Lanka stocks down as hartal cripples crisis-hit economy

ECONOMYNEXT – Sri Lanka’s main stock index slipped for the third straight session, falling near 2 percent, as an islandwide hartal crippled the country’s economic activities and businesses, dealers said.

The main All Share Price Index (ASPI) fell 1.85 percent or 140.07 points to 7,427.48 at the close.

The most liquid index S&P SL20 plunged 3.16 percent or 78.30 points to close at 2,401.21.

An islandwide hartal demanding the resignation of President Gotabaya Rajapaksa and the incumbent government closed businesses, hit public transport, and compelled the closure of many financial institutions.

“The uncertainties on the political side are creeping on in the investor sentiment in a big way since there seems to be no solution coming from the parliament. This is an indication that an economic recovery is nowhere in the sight,”a market analyst told Economy Next.

On Friday, Sri Lanka’s parliament announced that the parliament will be closed till May 17, signalling the ruling party’s delay in facing a no-confidence motion against it submitted by the main opposition.

This move the analyst said will further dampen investor confidence and will continue the downward trend.

“There is a loss of confidence in the market. This decision is very bad on the market,” he said.

Market analysts previously said that investors were disappointed with the way the island’s politics was moving despite the people’s call for transparency and stability.

On Thursday, after the market closed the parliament saw the election of a deputy speaker with 148 votes with the backing of the government’s ruling party in the 225-member legislature. The move showed the government still holds the parliament majority though it is likely to change depending on the subject of vote, analysts say.

The day’s turnover was 973 million rupees, less than a quarter of this year’s average daily turnover of 4.3 billion rupees.

In the past few weeks, Sri Lanka’s stock market bottomed out close to 50 percent which analysts said would attract a lot of bargain hunters and boost buying in the market.

Sri Lanka’s usable foreign currency reserves have dropped to less than 50 million US dollars or equivalent to a day’s import requirement, signalling the country’s inability in importing goods in the future.

The 84.5 billion economy has already suspended foreign debt payments as it had run out of dollars.

The youth-led protests demanding the resignation of President Gotabaya Rajapaksa and his government continued for the 28th day near the presidential secretariat and the agitation has deprived Rajapaksa of appearing in the public. Already the protests have led to the resignation of the cabinet and a central bank governor.

But the apolitical protesters have demanded nothing short of Rajapaksa’s resignation, raising the political risks in the island nation which saw strong political stability under the incumbent president until early April this year.

Investors are also concerned over the steep fall in the rupee, which has fallen over 80 percent since it was allowed flexibility on March 7.

The market has lost x.xx percent in Nay following a loss of 14.5 percent in March and 23 percent in April. Overall the market has lost 39.2 percent so far this year after being one of the world’s best stock markets with an 80 percent return last year.

Foreign investors bucked the trend and bought a net 135million rupees’ worth of shares. However, the market has witnessed a total foreign outflow of 994 million rupees so far this year.

LOLC, Expolanka, and John Keells pushed the index down on Friday.

Shares in LOLC Holdings fell 9.2 percent to close at 415.50 rupees a share, Expolanka Holdings fell 6.6 percent to close at 148.50 rupees a share, John Keells ended 3.9 percent down at 124.00 rupees a share. (Colombo/May6/2022)

Sri Lanka rupee remains at 375 against the US dollar

ECONOMYNEXT – Sri Lanka’s commercial banks quoted the rupee at 375 on the week ending May 06 while the secondary bond market witnessed sporadic activity, participants said.

The kerb market ended the week around 397/400 to the US dollar on May 07.

The central bank’s indicative spot was quoted at 358.5 against the US dollar on Friday while the TT rate was 361.7/374.9 against the US almost close to the commercial bank rates.t

Sri Lanka’s new Central Bank Governor Nandalal Weerasinghe jacked-up policy rates to 14.50 percent from 7.50 percent and also allowed Treasury bill yields to rise which would eventually slow private credit and investment and imports.

The falling rupee had also impoverished the population of the island which will reduce consumption and support the rupee as long as not new money is printed.

Sri Lanka’s rupee fell steeply after an attempted float in March due to low policy rates and a surrender rule. Electricity prices were also not raised, driving bank credit up with losses, unlike a float in 2012 after printing money.

In debt markets, a bond maturing on 01.5.27 was quoted at 21.50/22.00 percent on Friday, easing from 21.75/21.90 per cent on Thursday.

Market participants said they saw some activity in 2025, 2022, three months and 12-month maturities.

A bond maturing on 01.06.2025 was quoted at 21.50/22.00 percent on Friday.

The three-month bill was quoted at 21.00/22.00 percent, easing from 22.00/22.50 percent on Thursday.

The 12-month bill was quoted at 23.00/24.00 percent, flat from the previous day’s close.

At Wednesday’s Treasuries auction yields stabilized with strong demand from genuine buyers, dealer said.

Sri Lanka is facing the worst currency crisis triggered by the island’s economists who maintain an intermediate regime central bank after it attempted to target an output gap. (Colombo/May 06/2022)

Sri Lanka tea exports lowest in 23 years

AFP- Crisis-struck Sri Lanka’s vital tea exports have dropped to their lowest level in 23 years, official figures showed Wednesday, hit by a fertiliser ban and the war in Ukraine

Tea is the island nation’s biggest export commodity, bringing in about $1.3 billion annually before the current economic downturn, the worst since independence in 1948.

But a bungled ban on fertiliser imports last year — introduced in a doomed effort to save foreign currency and avoid a debt default — hit growers hard, with production falling 18 per cent on-year for the period from November 2021 to February 2022.

Customs data showed that first-quarter exports in 2022 correspondingly plunged to 63.7 million kilos (140 million pounds), down from 69.8 million kilos in the January-March period last year.

The tally was the lowest since the first quarter of 1999 when the country shipped out 60.3 million kilos of tea.

Export earnings for the first quarter also declined, to $287 million from $338 million.

Tea brokering firm Asia Siyaka blamed the drop on the agrochemical ban, which was portrayed by the government as a push to turn Sri Lankan farming 100-percent organic.

The ban was lifted by October following backlash from the industry, but farmers were left unable to access imported fertiliser as the country simultaneously ran out of dollars.

Industry officials added that about 10 percent of Sri Lanka’s tea exports had also been affected by Russia’s invasion of Ukraine. Both countries are top buyers of the island’s aromatic black tea.

The country of 22 million lacks enough foreign currency to finance even the most essential imports such as food, fuel and medicines.

Dire shortages and galloping inflation have led to widespread protests calling for President Gotabaya Rajapaksa to step down.

Sri Lanka finance minister points to choice between 1991 India and...

ECONOMYNEXT – Sri Lanka’s Finance Minister Ali Sabry said the country could take up to 10 years to recover from the latest currency crisis if wrong decision are made, but could use it as a ‘blessing’ to put the country on a strong growth path.

“I am not sure if we could resolve this crisis even in two years,” Sabry told the parliament in his 44-minutes speech at the parliament on the current economic crisis.

“Whether we can resolve this crisis in 2 years or 10 years, it all depends on us.”

Typically Sri Lanka takes about 15 to 23 months for private credit to recover from a currency crises triggered by the island’s third world soft-peg according to analysts familiar with the central bank’s policy errors.

The steeper the depreciation – and the destruction of real capital and real income which has outcomes similar to the Tanzi effect – the longer it will take.

The policy errors come from anchor conflicts described in the impossible trinity of monetary policy objectives (when money is printed and the currency peg comes under pressure, exchange controls are imposed instead of raising rates).

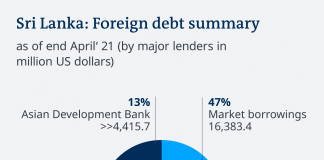

Sri Lanka in April 2022 suspended payments on foreign loans, after sovereign bond holdings ratcheted up during three currency crises from 2015 to 2022.

With the broken peg the island nation of 22 million is unable to match inflows to outflows, and the country is facing shortages of medicine, food like milk powder, fuel and power cut in the worst soft-pegged crisis in the central banks 72 year history.

Sabry said Sri Lanka’s usable liquid foreign reserves are less than 50 million US dollars, which is adequate to finance less than a day’s imports.

An attempt to float the currency – suspend convertibility – and match outflows to inflows without a reserve pass through has so far not fully succeeded and forex shortages persist

Under floating exchange rate no foreign reserves are needed to operate a monetary regime as the central bank does not buy or sell dollars (there is no reserve pass-through of inflows and outflows).

Demand for dollars and supply of dollars is matched outside the monetary base and reserve money is unaffected by dollar flows. The US Fed, Bank of England or the ECB does not provide one cent of money for imports.

Analysts have blamed a surrender rule which forces reserve pass through of inflows for the delay in restoring monetary stability.

The rupee has since fallen to 370 rupees to the US dollar so far in May from 203 when the attempt to float the currency started in March.

“We have a huge responsibility towards the future generation if we use this crisis in a short period like how India used its 1990s crisis as a turning point to recover strongly or if we would become like Lebanon or Venezuela,” Sabry said.

Sri Lanka’s central bank started with its fundamentally flawed Latin America style central bank with the rupee at 4.70 to the US dollar legislatively breaking currency board which has kept the country stable since 1885.

Sri Lanka is one of several central banks by the Federal Reserve in Latin America and Asia including Iran using a cookie cutter law devised by its once time Latin America division chief who was an admirer of Raul Prebisch and his Argentina central bank set up in 1935, which has defaulted repeatedly.

“Argentina’s experience served as an inspiration for Robert Triffin’s work concerning the revision

of the structure and functions of central banks in developing countries, which was reflected in the laws of Paraguay, Guatemala, the Dominican Republic and Ecuador,” wrote Felipe Pazo in CEPA Review of April 1998.

“These, in their turn, served in part as a model for the laws which created the central banks of Chile and Honduras and for the modifications made in the banking laws of El Salvador and Venezuela.

“The work of Raul Prebisch can thus be said to have been the basis for the contemporary central

banking system in Latin America.”

El Salvardor’s currency has since died and the country is dollarized, as had several Latin American cookie cutter central. Prebisch himself served as a consultant to Venezuela central bank in 1947.

Sabry said the government will present a new budget in the near future with tax increases as the government revenue has fallen to record low of 8.7 percent of the GDP by end-2021.

Sabry said the country could either use it to come back strongly or allow the island nation to suffer further.

India faced a currency crisis in 1991 as large volumes ‘special issue Treasury bills’ were bought running down foreign reserves.

India had to ship its last gold reserves but engaged in a strong reform program backed by the IMF and World Bank with trigger happy anti-austerity economists put on a backfoot.

The crisis, however, paved the way for the liberalisation of the Indian economy, since one of the structural reform conditions stipulated in the World Bank and IMF loan, required India to open itself up to participation from foreign entities in its industries, including its state-owned enterprises.

Lebanon’s central bank has record for stability in recent years but its policy started to grow wrong from 2016, when instead of raising rates to sterilize inflows it started to borrow dollars at high rates from the domestic market much like Sri Lanka’s central bank swapped dollars.

Sri Lanka’s economic crisis has led to political crisis and thousands of your-led protesters are agitating near President Gotabaya Rajapaksa’s office in the commercial heart of capital Colombo demanding the resignation of President and his brother Prime Minister Mahinda Rajapaksa.

Both leaders have defied calls, to step down citing that they were chosen by a democratic election with popular mandates. (Colombo/May05/2022)

Fed hikes rates as Powell bubble drives up food prices and...

ECONOMYNEXT- Federal Reserve Jerome Powell who fired a global commodity and food price bubble by printing large volumes of money into a healthy US banking system has hiked rates 50 basis points and promised to withdraw liquidity by selling down Treasury bills and agency debt.

“With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong,” the Fed said in a statement.

“In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate.

“In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.”

The Fed fired a global commodity bubble as the main reserve currency central bank falsely blaming earlier high inflation on supply chains, firing hunger in developing countries which are also pegged to the US dollar loosely or tightly.

Fed in his disinformation campaign was backed by complacent media and stimulus happy ‘economists’.

Powell is now blaming Russia’s invasion for high food prices, even as it raises interest rates.

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship,” the Fed said artfully, deflecting attention from its own actions.

“The implications for the U.S. economy are highly uncertain.”

The Powell fed fired the current bubble partly by eliminating the concept of excess reserves and the interest rate on reserve balances, critics say.

The IORB rate was also hiked to 0.9 percent.

Sri Lanka and many developing countries are facing higher food and energy prices (in US dollar terms) by the policy errors of the Fed which are primarily driven by an employment target (stimulus).

Sri Lanka also compromised its monetary stability using flexible inflation targeting, with the central bank giving itself full discretion under ‘central bank independence’ creating three currency crises in a row by torpedoing it pegged regime with money printed to target an output gap (stimulus).

However the central bank has now abandoned stimulus in a bid to stabilize its third rate peg by slowing economic activity. Policy rates have been raised to 14.50 percent from 7.50 percent and inflation hit 29.8 percent in April.

Analysts, classical economists have called for rule based, non-conflicting monetary policy to restrain the central bank and its monetary board from printing money, to trigger instability though output gap targeting, flexible inflation targeting and or any other fancy labels that violate the rule of the impossible trinity.

Sri Lanka is now facing the worst currency and monetary crisis triggered by the central bank in its 72 year history of creating forex shortages and balance of payments deficits since it was set up in 1950, abolishing a currency board (rule based monetary policy).

Fed has fired the highest inflation in 40 years, when Paul Volcker, a classical economists tamed the Fed in the early 1980s.

The Fed implementation note extracts.

“Effective May 5, 2022, the Federal Open Market Committee directs the Desk to:

Undertake open market operations as necessary to maintain the federal funds rate in a target range of 3/4 to 1 percent.

Conduct overnight repurchase agreement operations with a minimum bid rate of 1.0 percent and with an aggregate operation limit of $500 billion; the aggregate operation limit can be temporarily increased at the discretion of the Chair.

Conduct overnight reverse repurchase agreement operations at an offering rate of 0.8 percent and with a per-counterparty limit of $160 billion per day; the per-counterparty limit can be temporarily increased at the discretion of the Chair.

Roll over at auction the amount of principal payments from the Federal Reserve’s holdings of Treasury securities maturing in the calendar month of June that exceeds a monthly cap of $30 billion. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap.

Reinvest into agency mortgage-backed securities (MBS) the amount of principal payments from the Federal Reserve’s holdings of agency debt and agency MBS received in the calendar month of June that exceeds a monthly cap of $17.5 billion.

Allow modest deviations from stated amounts for reinvestments, if needed for operational reasons.

Engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve’s agency MBS transactions.”

In a related action, the Board of Governors of the Federal Reserve System voted unanimously to approve a 1/2 percentage point increase in the primary credit rate to 1 percent, effective May 5, 2022.

How the Fed plans to ‘unprint money’ (reduce Treasury bill and other bond holdings)

Consistent with the Principles for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in January 2022, all Committee participants agreed to the following plans for significantly reducing the Federal Reserve’s securities holdings.

The Committee intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Over time, the Committee intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime.

To ensure a smooth transition, the Committee intends to slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves.

Once balance sheet runoff has ceased, reserve balances will likely continue to decline for a time, reflecting growth in other Federal Reserve liabilities, until the Committee judges that reserve balances are at an ample level.

Thereafter, the Committee will manage securities holdings as needed to maintain ample reserves over time.

The Committee is prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments. (Colombo/May05/2022)

Sri Lanka rupee tops 370 to the dollar, reaches UAE levels

ECONOMYNEXT – Sri Lanka’s rupee was offered at 370 to the US dollar for telegraphic transfers for small transactions while larger deals went at higher rates near 380 to the US dollar market participants said.

UAE exchange houses were offering a Dirham for around 102 rupees (375 rupees per dollar), which will help drive more remittances to official channels, market participants said.

Sri Lanka’s new Central Bank Governor Nandalal Weerasinghe jacked up policy rates to 14.50 percent from 7.50 percent and also allowed Treasury bill yields to rise which would eventually slow private credit and investment and imports.

The falling rupee had also impoverished the population of the island which will reduce consumption and support the rupee as long as not new money is printed.

Related

Sri Lanka rupee will definitely stabilize based on policy actions: CB Governor

Sri Lanka’s rupee fell steeply after an attempted float in March due to low policy rates and a surrender rule. Electricity prices were also not raised, driving bank credit up with losses, unlike a float in 2012 after printing money.

There was hardly any activity in the interbank market.

In debt markets a bond maturing on 01.5.27 was quoted at 21.30/22.10 per cent.

At Wednesday’s Treauries auction yields stabilized with strong demand from genuine buyers, dealer said.

Sri Lanka is facing the worst currency crisis in its history after two years of money printing to keep rates down.

Sri Lanka is facing the worst currency crises triggered by the island’s economists who maintain an intermediate regime central bank after it attempted to target an output gap. (Colombo/May 05/2022)

Sri Lanka police arrests 12 protestors outside parliament; opposition demands release

ECONOMYNEXT – Sri Lanka police arrested 12 people near the parliament complex on Wednesday (04) allegedly for obstructing the vehicles of MPs.

Police Media told EconomyNext that the group were arrested by officers on duty near the parliament, but was unable to confirm what police station the protestors had been taken to.

Footage aired on the privately owned NewsFirst network showed protestors being forced into a police bus, even as protestors shouted angrily that they had a right to protest. A police officer at the site was heard shouting back that hooting at MPs was a violation of their parliamentary privileges.

Main opposition Samagi Jana Balavegaya (SJB) MP Patali Champika Ranawaka told parliament that the arrested people had arrived at the parliament gate to hand over a letter to the Speaker.

“After this was communicated to parliamentary officials, the Speaker’s media secretary to went to the gate and accepted the letter on the Speaker’s behalf,” said Ranawaka.

According to Ranawaka, the group were taken to the Maharagama police station.

“I asked the speaker to intervene in this matter and find out on what basis these people were arrested after the letter was accepted by his media secretary,” the MP said.

Commenting on the arrests, the Bar Association of Sri Lanka (BASL) called on the government, the police and the armed forces to act with restraint.

“It should be noted that those engaged in lawful exercise of their right to protest cannot be arrested. We reiterate that the right of the public to protest in a peaceful manner must be respected and upheld. We also stress that such protests must be peaceful at all times,” the BASL said in a statement.

SJB and opposition leader Sajith Premadasa, meanwhile, said freedom of expression must be upheld in Sri Lanka as a priority.

“This is a democratic country. Do these protesters lose their freedom after giving a letter to the speaker?” Premadasa asked parliament.

“I request the speaker to call the police station and ask them to release these people. Expressing their opinions is a fundamental right of the people. If they lose that freedom, they will go for other actions,” he said.

Protests have erupted across Sri Lanka against the government over its handling of Sri Lanka’s worsening economic crisis. Finance Minister Ali Sabry told parliament on Wednesday that Sri Lanka’s usable foreign reserves were down to 50 million US dollars and it may take six months to wrap up a deal with the International Monetary Fund (IMF). (Colombo/May04/2022)