FASHION WEEK

- All

- 2019 Presidential Election Sri Lanka

- 2020 General Election Sri Lanka

- 2021 Ishalini's Death

- 2021 Port City Bill

- 2022 Gota Go Home

- 2024 Presidential Election

- 20th Amendment

- 46th session of the Human Rights Council

- 50 days Political upheaval in Sri Lanka

- About

- Ama H. Vanniarachchy

- Archaeology

- Archaeology

- Article

- Biography

- Bond Scam Sri Lanka

- Buddhist monks

- Civil War

- Container 323

- Cultural

- Dollar Crisis Sri Lanka

- Dr. Sarath Weerasekera

- Easter Sunday attacks

- Education

- Election Manifesto

- Events

- F.R. Jayasuriya Foundation

- F.R.Jayasuriya

- featured

- Fertilizer Crisis Sri Lanka

- Gas Explosion

- Highways and Bridges

- Historical

- International

- Keerthi Jayasuriya

- Magazine

- News

- Novel

- Official Language Debate

- Other

- Palitha Senanayake

- Places

- Political

- Politics

- Port City

- Prasad Powatte

- Ranjan Ramanayake leaked

- Religious

- Report

- Review

- Sport

- Sports

- Thissa Viharaya, Jaffna

- Underworld

- video

- World affairs

- දෙව්සිරි පී. හේවාවිදාන

DON'T MISS

- All

- 2019 Presidential Election Sri Lanka

- 2020 General Election Sri Lanka

- 2021 Ishalini's Death

- 2021 Port City Bill

- 2022 Gota Go Home

- 2024 Presidential Election

- 20th Amendment

- 46th session of the Human Rights Council

- 50 days Political upheaval in Sri Lanka

- About

- Ama H. Vanniarachchy

- Archaeology

- Archaeology

- Article

- Biography

- Bond Scam Sri Lanka

- Buddhist monks

- Civil War

- Container 323

- Cultural

- Dollar Crisis Sri Lanka

- Dr. Sarath Weerasekera

- Easter Sunday attacks

- Education

- Election Manifesto

- Events

- F.R. Jayasuriya Foundation

- F.R.Jayasuriya

- featured

- Fertilizer Crisis Sri Lanka

- Gas Explosion

- Highways and Bridges

- Historical

- International

- Keerthi Jayasuriya

- Magazine

- News

- Novel

- Official Language Debate

- Other

- Palitha Senanayake

- Places

- Political

- Politics

- Port City

- Prasad Powatte

- Ranjan Ramanayake leaked

- Religious

- Report

- Review

- Sport

- Sports

- Thissa Viharaya, Jaffna

- Underworld

- video

- World affairs

- දෙව්සිරි පී. හේවාවිදාන

Sri Lanka stocks end steady; economic concerns, fuel shortage weigh

ECONOMYNEXT – Sri Lanka’s stock exchange index closed steady on Tuesday (22) from a more than two-month low after it posted its worst fall in 16 months in the previous session on margin calls and economic woes.

The main All Share Price Index (ASPI), closed 0.01 percent or 0.93 points up at 11,592.30 points.

The market opened lower and managed a significant recovery during the mid-day trade, almost gaining 100 points however the selling pressure returned and gains were surrendered.

“The gain seen during the day as a result of investors buying in at the bottom line,” s top analyst said.

“Buying came in heavy but the selling pressure does not seem to settle. It erased away today’s gain too but it did slow down.”

He said the investors who have been holding on for a long period sold their shares when the opportunity came.

On Monday (21), ASPI lost 542 points to close at its lowest since since October 05, 2021.

This plunge saw the market index losing 5.9 percent so far this year and 10.2 percent so far for the month despite listed companies posting better than expected earnings in the December quarter.

Analysts on Monday said if the fuel shortage and power cuts continue, the market condition would worsen.

SL20 of the more liquid index closed 0.03 percent or 1.06 points up at 3,933.84.

Analysts had predicted a downtrend in the market due to the uncertainties in the market and the economy.

The day’s turnover was 2.8 billion rupees, less than half of this year’s average turnover of 6.8 billion rupees.

The market has been in a declining trend due to the ongoing forex crisis most companies are going through, despite many companies posting better-than-expected earnings in the December quarter.

The rupee exchange rate is fixed at around 200 rupees by the central bank, but it is now above 250 rupees per dollar in the grey market.

Foreign investors, who are highly worried about possible sharp depreciation or devaluation in the currency, bucked the trend and bought a net of 81.6 million rupees worth shares on Tuesday.

The foreign sales of shares so far this year have been 3.2 billion rupees. In 2021, the Sri Lanka stock market suffered a net foreign outflow of 50 billion rupees.

Analysts had predicted that the economic concerns would drag the market from time to time until the government finds a sustainable solution for the country’s looming debt crisis.

Vallibel One, Commercial Bank and Sampath Bank kept the market steady on Tuesday.

Vallibel One gained 4.96 percent to close at 71.90 rupees a share, while Commercial bank rose 1.21 percent to 81.00 rupees a share.

Sampath Bank rose 1.11 percent to close at 54.80 rupees.

Expolanka, the market heavyweight that has export and freight businesses gained 0.35 percent to 286.50 rupees a share.

(Colombo/Feb22/2022)

LATEST NEWS

Container 323: A Deep-Dive Investigation into Port Clearance Irregularities

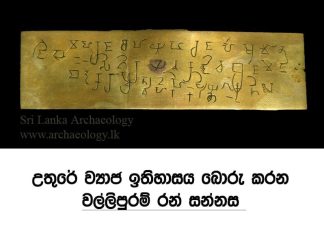

උතුරේ ව්යාජ ඉතිහාසය බොරු කරන වල්ලිපුරම් රන් සන්නස..

නැති අයිතියක් පෙන්නලා උතුරේ ඉඩම් කොල්ලකන්න හදන ජාතීන්වාදීන්ගේ උප්පරවැට්ටි

POPULAR ARTICLES

Sri Lanka has to print money for state salaries, weakening rupee: Prime Minister

ECONOMYNEXT – Sri Lanka’s Prime Minister Ranil Wickremesinghe said he had to with “great unwillingness” give permission to print money to pay state salaries, despite the move putting further pressure on the rupee to depreciate.

“With great unwillingness (dhadi ukker-math-th-en) I have to give permission to print money,” Prime Minister Wickremesinghe said in a televised address.

“That is to pay the salaries of state workers to pay for essential goods and services.

“However we have to keep in mind that printing money will depreciate the rupee.”

Related

Sri Lanka money printing in 2022 reaches Rs588bn in first quarter

When people use printed money to buy goods on the shelves or petrol to travel, there are no dollars in the forex market to for importers to buy using the newly printed money, leading to an outflow of dollars that exceed the inflows of dollars and breaking a soft-peg.

Sri Lanka’s central bank which was created by dismantling a currency board which had kept economy stable through two world wars and a great depreciation had busted the rupee from 4.77 to the US dollar to around 380 to the dollar so far since 1950.

Despite double digit growth in exports and a surge of tourists in the winter season, Sri Lanka was still unable to buy dollars for big ticket import bills like fuel and tourists who paid dollars, had to face power cuts.

Data showed that 588 billion rupees had been printed in the first quarter including for debt repayment.

Prime Minister Wickremesinghe said the Treasury was unable to find 5 million US dollar to pay for LP Gas imports.

If there is no monetary instability and there is credible peg or a working floating exchange rate the Treasury or the central bank does not have to give any dollars to import fuel and dollars are bought for rupees in the open market.

LP Gas companies instead of depending on subsidies in the form of dollars or rupees from the Treasury pays taxes to the government.

However when money is printed, dollars cannot be bought to pay for oil or settle loans, leading to more borrowings. Prime Minister Wickremesinghe is now looking for 3 to 4 billion US dollars in ‘bridging finance’ amid monetary instability.

Similar borrowings in forex shortages created in 2015/2016 and 2018 led to a steep foreign borrowings and eventual default during the 2020-2022 crisis, the worst in the history of the soft-pegged central bank.

Most private citizens are net savers and import less than they earn.

The private sector as a whole saves over 20 percent of gross domestic product, making it easy for a central bank to accumulate reserves and maintain a stable exchange rate unless it tries to keep interest rates down artificially by printing money and triggering excess import demand.

The central bank has recently raised rates which is expected to reduce domestic private credit, investment, drive more savings into the budget and reduce pressure on the rupee.

However if money is printed, forex shortages would persist for a longer period making it difficult to import fuel and gas.

Sri Lanka’s economic troubles started shortly after the creation of a Latin America style central bank in 1950 by a US money doctor and economists used the agency to suppress interest rates, finance deficit after expanding the state, creating monetary instability.

Classical economists have called for a currency board to stop monetary instability, impose rules on both the central bank and Treasury (a hard budget constraint) which will allow Sri Lanka to grow like East Asia and protect the poor from interventionists. (Colombo/May17/2022)

Catholic Priest Destroyed the Entire Mayan Written Language

Sri Lanka’s power cuts to last up to 4-years without renewable sources : PUCSL

ECONOMYNEXT-Sri Lanka’s power situation will remain precarious for the next 3 to 4 years if the officials do not diversify energy generation methods and bring in renewables, the island’s utility regulator has warned.

Speaking at a media briefing on Thursday (09) Janaka Rathnayake, Chairman of the Public Utilities Commission of Sri Lanka said that Sri Lanka can continue with 3-hour power cuts till December this year with the existing resources.

The island would have to import around 500 million US dollars worth of fuel if it is to go till December with no power cuts, he said.

Sri Lanka uses a mix of hydropower, thermal energy and a small amount of wind power to generate energy.

A period of drought compounded by a forex crisis that left the country unable to import fuel for power generation resulted in the ongoing power cuts that once lasted up to 13 hours long.

Rathnayake warned that if a similar drought occurs in February to April next year, the situation would be dire for the next 3 to 4 years, as Sri Lanka does not have the foreign reserves required to purchase fuel.

The nation is currently surviving on Indian credit lines for fuel.

“We can go on until December but the trouble is that this will not stop then,” Rathnayake said.

“If there is a period with no rainfall in Feb March April next year, if we do not use renewables or something and increase generation plants somehow, this situation can continue for the next four to five years.”

Power and Energy Minister Kanchana Wijesekara stated in a press briefing Friday (10) that government offices, schools and other institutions were implementing a request to install solar panels to help with the energy crisis.

Critics say that the request is impractical, as existing buildings do not have the roof space or capital required to install a sufficient number of solar panels per institution.

Wijesekara had also tweeted in May that he hoped “to encourage foreign direct investments as well as opportunities to local developers to participate in the Renewable Energy Plans.”

Sri Lanka’s plans for renewable energy generation have historically been benched due to delays due to bureaucracy and corruption within institutions.

Former State Minister of Energy Duminda Dissanayake told Parliament that: “When you go for tender, they drag it for years and we will be compelled to buy diesel on which some (corrupt) officials want.”

The island’s latest wind power project with the Indian Adani company is also marred by controversy.(Colombo/Jun11/2022)

LATEST REVIEWS

Marxist youth in Sri Lanka protest outside president’s office, attempt break-in

ECONOMYNEXT – Marxist youth affiliated with the opposition Janatha Vimukthi Peramuna (JVP) protested the government’s handling of Sri Lanka’s worsening economic crisis on Friday (18) outside the president’s office, culminating in some protestors attempting a break-in.

The JVP-affiliated Socialist Youth Union (SYU) marched from the Maradana Technical Junction to the Presidential Secretariat in Colombo Friday morning, carrying placards and shouting slogans against the ruling Sri Lanka Podujana Peramuna (SLPP), President Gotabaya Rajapaksa and others.

Sri Lanka is going through one of the worst economic crises in the country’s history as a severe dollar shortage has led to daily power outages and long queues for essentials including fuel. The protestors also demanded the cancellation of a power deal with a US energy company and a deal with India to manage a decades-old oil tank farm in the Eastern district of Trincomalee.

Reports said a group of protestors had broken into the presidential secretariat causing a commotion. However, the situation seemed to have been brought under control by mid afternoon by which time the protest had ended.

Organiser Eranga Gunasekera could be heard calling to the youths connected to different political parties to join the SYU.

“The youth of the SLPP who have gotten the boot can come join the JVP. The youth that want to get the boot can stay with SJB.”

On Tuesday (15), the main opposition Samagi Jana Balavegaya (SJB) led a protest march that saw thousands of party supporters gathered outside the presidential secretariat in a similar expression of apparent anger towards the government. (Colombo/Mar18/2022)