lanka

Sovereignty of a Nation – The Sri Lankan Encounter

IMF Report for Sri Lanka 2022

Ministers Rajapaksa, Jaishankar and Sitharaman witness the signing of the USD...

ඉතිහාසය හෙවත් ලක්දිව්වාසී ජනයා පිළිබඳ වූ පුරාණ කාලයෙහි කතාදිය

Carl Muller – Yakada Yaka

Sri Lanka stocks suffer worst loss since October 2020 as margin...

ECONOMYNEXT – Sri Lanka’s stock index plunged 4.47 percent on Monday (21) to its lowest since October 2020 as margin calls on declining shares and economic woes visibly kicked in the form of power cuts and fuel shortage weighed on investor sentiment, brokers said.

The main All Share Price Index (ASPI), closed 542 points lower at 11,591.37 points, its lowest since October 05, 2021.

The index has lost 5.9 percent so far this year and 10.2 percent so far for the month despite listed companies posting better than expected earnings in the December quarter.

“We usually see sales at month ends, but it has worsened with the reports of power cuts and fuel shortages as the people feel the brunt of the economic crisis in the country,” a top analyst said.

“I expect the trend to continue till the month-end. I don’t think there will be a recovery any time soon and if the power cuts aggravate definitely it will worsen.”

Another analyst said the margin calls have forced investors to sell their shares to recover credit for stock purchase.

Sri Lanka announced a maximum three hour power cut as the country’s forex shortage has led to fuel scarcity due to lack of dollars to import fuel.

SL20 of the more liquid index closed 5.02 percent or 207.88 points weaker at 3,932.78. The fall of this index prompted the market to temporarily halt trading as the plunge was over 5 percent.

Analysts had predicted a downtrend in the market due to the uncertainties in the market and the economy. The market lost 2.6 percent last week.

The day’s turnover was 4.2 billion rupees, lower than this year’s average turnover of 6.8 billion rupees.

The market has been in a declining trend due to the ongoing forex crisis most companies are going through, despite many companies posting better-than-expected earnings in the December quarter.

The rupee exchange rate is fixed at around 200 rupees by the central bank, but it is now above 250 rupees per dollar in the grey market.

Foreign investors, who are highly worried about possible sharp depreciation or devaluation in the currency, bucked the trend and bought a net of 79.9 million rupees worth shares on Monday.

The foreign sales of shares so far this year have been 3.3 billion rupees. In 2021, the Sri Lanka stock market suffered a net foreign outflow of 50 billion rupees.

Analysts had predicted that the economic concerns would drag the market from time to time until the government finds a sustainable solution for the country’s looming debt crisis.

LOLC Holdings, Expolanka and Royal Ceramic dragged the market down on Monday.

LOLC Holdings fell 9.41 percent to close at 1,025.00 rupees a share, while Expolanka, the market heavyweight that has export and freight businesses plunged 8.49 percent to 288.00 rupees a share.

Royal Ceramic lost 7.96 percent to 61.30 rupees a share. (Colombo/Feb21/2022)

Sri Lanka shares slip to one-week low amid forced selling

Roses dominate in Sri Lanka’s picked up valentine sales

Sri Lanka crisis committee on essential items eyes New Year needs

ECONOMYNEXT – A crisis committee appointed by President Gotabaya Rajapaksa to ensure essential items are available amid a forex shortage has focused on the needs of an April 2022 New Year season, its chief Finance Minister Basil Rajapaksa has said.

Sri Lanka is facing severe forex shortages, amid excess rupees produced by the central bank to keep interest rates low and fixed and imports are soaring.

“Our first task is to provide consumers essential items without a shortage in Sinhala-Hindu New Year that is up coming up,” he told meeting at the Finance Ministry earlier this week.

“It is not only that period, we want to make sure it happens even after that. It is mainly the responsibility of the two trade ministries.”

As of February 11 there, cement, wheat and cooking gas were in short supply but there were stocks of most other goods, Minister Rajapaksa had said.

Minister Dayasiri Jayasekera had a problem with good being priced differently in some districts.

Television channels showed people queuing up for cement this week.

President Gotabaya ordered the committee to be formed on February 07.

Sporadic shortages have been seen as foreign exchange releases for shipments were delayed amid money printing and credit which was driving imports to high levels.

Sri Lanka’s central bank has provided US dollars to importers as containers got stuck at Colombo Port and fuel ships also arrived in Colombo and waited for the letters of credit to be cleared from around September 2021.

Sri Lanka inflation is soaring and severe forex shortages have emerged as money was printed continuously from around February 2020 to create a ‘production economy’ blowing the balance of payments apart.

Analysts and economists have called for a revamp of the country’s monetary law to stop the central bank from printing money to manipulate interest rates. Politicians passed the law in 1950 to enable money printing, and the rupee which was fixed from 1885 started to collapse.

Sri Lanka is currently printing money to sterilize interventions (after giving reserves for imports) and maintain a 6.5 percent policy rate, which is less than half the 14.2 percent inflation generated by the central bank in the year to January 2022 by printing money.

The central bank is also printing money to give an eight rupee subsidy to expat workers who send dollars through official channel. The money boomerangs on the 200 to the US dollar peg triggering more forex shortages.

The central bank is also creating money through a forex surrender requirement, but dollar sales to commercial banks are exceeding purchases. (Colombo/Feb13/2022)

Sri Lanka senior legislators, ex-speaker call for debt-renegotiation, correct policies

ECONOMYNEXT – Senior Sri Lanka opposition figures and an ex-speaker have called for “orderly re-negotiation of sovereign debt” and “correct policies” for sustainable growth as the country heads for currency depreciation and possible default due to money printing.

Sri Lanka’s government external debt has reached nearly 120 percent, interest payments were also excessively high as a share of state revenues and there were forex shortages, the legislators and ex-speaker said.

“In such a context, we recognize the best way forward for Sri Lanka is to immediately initiate a multi-step process towards an orderly negotiated postponement and restructure of repayment of its sovereign debt,” the group said.

“Sri Lanka can then correct its policies towards a path of sustainable economic growth and debt management , while also ensuring access to essential needs and goods for the Sri Lankan economy and Its people .”

“We recognize that undoubtedly the government has a daunting task ahead, and as a country there is a need for us all to come together to overcome this challenge.

“We further acknowledge the need for sound reform to the national economic policy that will address the root causes for this situation and ensure sustainable solutions to steer the country out of this unprecedented economic crisis, and forge an equitable and just solution for our future generations.”

The statement came following a bi-partisan meeting of legislators which included several ruling party members who are concerned about the current economic problems.

The opposition also called for the welfare of the poorest communities.

“We acknowledge that Sri Lanka should take immediate measures to ensure strong social welfare for its people so that the poor and vulnerable communities are protected from the adverse impact of this economic crisis,” the statement said.

However unlike other countries that had severe debt problems like Greece which was part of the Euro region or Ecuador which is now dollarized and could not depreciate the currency, Sri Lanka has its own rupee which is weakened by money printed to keep interest rates down.

As a result a fall of the currency would further push up inflation and destroy the real value of pensions, rupee denominated bank deposits and salaries while also pushing the cost of exported and imported goods including foods.

Analysts had warned for several years that the hardship people face in a soft-pegged country with depreciated money is not the budget cuts opposed by the anti-austerity brigade such as in Eurorized Greece, but is that of Latin American collapsing pegged currencies.

Sri Lanka’s legislators themselves had given wide powers for the central bank to print money, create forex shortages, depreciate the currency (in the first central bank law the currency could not be depreciated without approval) and also impose exchange controls and interest controls.

Using the central bank’s money printing power, successive governments had had engaged in inflationary deficit financing and blamed other causes for both inflation and forex shortages.

Sri Lanka in 2019 slashed taxes for ‘stimulus’ and the central bank printed the highest volume of money in its history to prevent interest rates from going up, leading to a severe external drain.

The central bank itself is now indebted.

Analysts and economists had called for rule based central bank control, which also serves as a hard budget constraint to stop deficit spending.

Sri Lanka from September started to use foreign reserves for imports as forex shortages became acute.

In the normal course of business foreign reserves are not used for imports but small amounts are collected each month to re-build reserves and repay lumpy debt.

When reserves are depleted the only course of option available is to hike rates and float the currency to stop reserves from being used for imports and sterilized with new money.

The full statement is reproduced below:

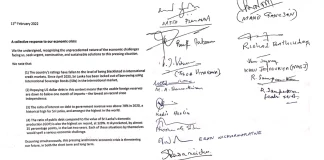

11th February 2022

A collective response to our economic crisis:

We the undersigned, recognizing the unprecedented nature of the economic challenges facing us, seek urgent, constructive, and sustainable solutions to this pressing situation.

We note that:

(1) The country’s ratings have fallen to the level of being blacklisted in International credit markets. Since April 2020, Sri Lanka has been locked out of borrowing using International Sovereign Bonds (ISBs) in the International market,

(2) Repaying US dollar debt in this context means that the usable foreign reserves are down to below one month of imports – the lowest on record since independence.

(3) The ratio of interest on debt to government revenue was above 70% in 2020, a historical high for Sri Lanka, and amongst the highest in the world.

(4) The ratio of public debt compared to the value of Sri Lanka’s domestic production (GDP) is also the highest on record, at 120%. It skyrocketed, by almost 2S percentage points, in the last two years. Each of these situations by themselves would spell a serious economic challenge. •

‘ . . .

Occurring simultaneously, this pressing and historic’ e conomic crisis is threatening our future, in both the short term and long term.

We recognize that undoubtedly the government has a daunting task ahead, and as a country there is a need for’ us all to come together to overcome this challenge.

We acknowledge that Sri Lanka should take immediate measures to ensure strong social welfare for its people so that the poor and vulnerable communities are protected from the adverse impact of this economic crisis .

We further acknowledge the need for sound reform to the national economic policy that will address the root causes for this situation and ensure sustainable solutions to steer the country out of this unprecedented economic crisis, and forge an equitable and just solution for our future generations.

We are fully cognizant that Parliament has full control of public finance, and that each member of parliament has a fiduciary responsibility to ensure the proper management of public finances in Sri Lanka .

In such a context, we recognize the best way forward for Sri Lanka is to immediately initiate a multi-step process towards an orderly negotiated postponement and restructure of repayment of its sovereign debt. Sri Lanka can then correct its policies towards a path of sustainable economic growth and debt management , while also ensuring access to essential needs and goods for the Sri Lankan economy and Its people .

This will reduce the pain and hardship that is currently exper ie nced due to the shortage of foreign currency. In any path forward, it is essential that the government takes measures to consider the difficulties of the poorest and the most vulnerable people in the country and provide them with adequate social security, protection, and relief.