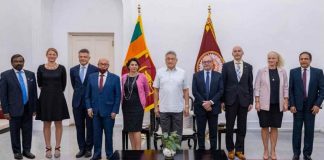

Sri Lanka President meets high powered IMF mission

ECONOMYNEXT – Sri Lanka’s President Gotabaya Rajapaksa has met a team from the International Monetary Fund who are in the island to negotiate a bailout involving tighter monetary and fiscal policies and a debt re-structuring.

The IMF mission was led Deputy Director of IMF’s Asia Pacific Department Anne-Marie Gulde. The IMF has also appointed senior mission chief Peter Breuer, who is Chief of the Debt Capital Markets Division, Monetary and Capital Market Department of the IMF.

IMF’s Mission Chief for Sri Lanka Masahiro Nozaki, Resident Representative for Sri Lanka Tubagus Feridhanusetyawan had also met President Rajapaksa.

“IMF representatives briefed the President regarding the preliminary round of discussions heldwith the Prime Minister, the Ministry of Finance, the Central Bank and other economic authorities and experts as well as regarding the current situation,” his office said in a statement.

“The delegation reaffirmed their commitment to support Sri Lanka at this difficult time, in line with the IMF’s policies.

“The President elaborated on the current economic situation and expressed his gratitude to the delegation for their support to Sri Lanka during difficult times.”

The IMF was invited to Sri Lanka at the request of President Gotabaya Rajapaksa at a time when state economists were still supporting ‘stimulus’.

Stimulus or money pritning became a fad during the Coronavirus crisis and was endorsed by the IMF and major reserve currency central banks also engaged in the practice creating a ‘hangover’ in the form of high inflation.

After the Fed fired a massive commodity bubble food prices are high around the world and Mercantilists are now claiming there is a ‘food crisis’ s just as they claimed at the height of the Greenspan-Bernanke bubble in 2008.

Sri Lanka defaulted on the its foreign debt after 7 years of aggressive monetary stimulus, involving call money rate targeting, real effective exchange rate targeting and output gap targeting, including with fiscal stimulus (tax cuts) which led to monetary instability and higher foreign borrowings.

The country is now trying to re-structure its foreign debt but is also attempting to borrow a whopping 6.0 billion dollars in 2022 amid enhanced monetary instability. (Colombo/June24/2022)

Sri Lanka stocks gain for 4th consecutive session to hit over...

ECONOMYNEXT – Sri Lanka stocks closed firmer for a fourth ]straight session on Friday, as investors expect the ongoing government discussions with the visiting 10-member International Monetary Fund (IMF) would end in a positive note to ease the current economic crisis, brokers said.

After the market closed the IMF delegation met President Gotabaya Rajapaksa to discuss about the current economic crisis, a presidential source said.

The main All Share Price Index (ASPI) closed 1.26% or 95.10 points higher at 7,651.19. It has gained 3.1% in the last four sessions.

Foreign investors, however, sold a net of 39.5 million rupees worth of shares on Friday. The market has suffered a total foreign outflow of more than 1.25 billion rupees so far this year.

“There is some hope of an IMF deal. So far nothing has happened as in the past. So investors believe that the outcome will help to stabilise the economy,” a market analyst said.

The turnover was 1.25 billion rupees, highest since June 07, but still around a third of this year’s daily average turnover of 3.52 billion rupees.

Analyst have said there is a lot of selling pressure in the market because the investors will not see an ideal investment climate at least for the next 9-months due to high interest rates and taxes.

Th 10-member IMF team arrived in Sri Lanka on Monday and began discussions on policy corrections with Prime Minister Ranil Wickremesinghe and the talks have been seen as positive for the investor sentiment. However, Sri Lanka must show progress on debt restructuring before IMF lends any money.

Market analysts have said investors were heavily feeling the pinch of economic crisis as the country’s fuel bunkers have dried out the island nation was frantically looking for dollars to purchase fuel.

The public sector and the schools have moved online for two weeks on the government’s advice to reduce transport and save fuel.

Though a new prime minister and a new cabinet have been appointed, analysts see little progress on both the economical and political fronts. The country is struggling to ensure a continuous supply of fuel due to a shortage of US dollars.

The more liquid S&P SL20 index gained 1.59% or 38.75 points to 2,470.19.

The market has so far lost 5.5 in June after gaining 6% in May. It lost 23% in April followed by a 14.5% fall in March.

The market has lost 37.4% so far this year after being one of the world’s best stock markets with an 80% return last year when large volumes of money were printed.

Sri Lanka’s sovereign debt default has already led the country to be rated with restricted/selective default rating by rating agencies, which has weighed on investor sentiment.

Investors are also concerned over the steep fall of the rupee from 203 to 370 levels so far in 2022.

Expolanka Holdings led the gain and ended 3.5% firmer to 192.25 rupees a share and brokers said its rupees cash dividend announced on Wednesday still attracting more investors.

LOLC Holdings Plc gained 4.1% to 436.25 rupees a share, while Hayleys ended 5.2% to 65.20 rupees a share. (Colombo/June 24/2022)

EU Ambassadors urge President to send firm message on future economic...

Crisis-hit Sri Lanka finally starts to deal with bloated public sector

ECONOMYNEXT – Sri Lanka is looking at ways to trim the public sector by allowing state workers to go on leave for other jobs both locally and abroad as a worsening economic crisis compels the island nation to reduce government expenditure.

The country is going through its worst ever forex crisis and the government is faced with the possibility of cutting down the number of employees in the state sector in order to manage a massive wage bill, even as talks begin with the International Monetary Fund (IMF) on a possible bailout.

Sri Lanka has more than 1.5 million public sector employees at present, the size having doubled over the past 15 years, according to official data. Efficiency in the public service is lower compared to that of Sri Lanka’s peers in Asia, despite there being a public servant for every 14 citizens.

Most state owned enterprises (SOEs) have become a dumping yard for politicians to recruit their supporters, resulting in more employees with very little do in spite of a monthly payments and pension scheme. Power and Energy Minister Kanchana Wijesekera recently said there are 26,000 employees working in the state-owned Ceylon Electricity Board (CEB) alone, an institution that can be run with just 5,000 employees.

In 2021, the government paid 86 cents as salaries and pension payment to public servants from every rupee it earned as tax revenue, leaving little for other public investments like health and education.

Many multilateral finance organisations including the IMF, the World Bank, and the Asian Development Bank (ADB) have advised Sri Lanka to reform the public sector and to keep it tight and efficient bu political leaders have been stubborn in their reluctance to heed the advice fearing political repercussions including electoral defeats.

However, the ongoing financial crisis has forced the government to look into alternatives, government sources said.

“We may either have to go for a salary cut or reduce the number of government servants by at least 30 percent as the first step,” a top government official told Economy Next.

This week, the Ministry of Public Administration came up with two key proposals to reduce the size of the public sector: No-pay leave for state sector employees to go for foreign jobs or to work locally in the private sector.

“It has been decided at the meeting of the Cabinet of Ministers held on 13.06.2022 to grant leave with no pay to be spent in/out of Sri Lanka to public officers under special provisions, deviating from the provisions existing in the Establishments Code regarding the granting of leave with no pay, until further notice,” M M P K Mayadunne, Secretary to the Ministry of Public Administration, Home Affairs, Provincial Councils and Local Government, said in a circular issued on Wednesday June 22.

“Public officers are able to obtain leave with no pay to go out of Sri Lanka subject to a total period of five (05) years maximum, so as to be applicable to seniority and pension.”

Public servants who are leaving the country for foreign jobs need to send remittances through formal channels, ranging from 100-500 US dollars monthly depending on their grades, the circular showed.

It has also addressed the key issues of seniority and eligibility for pensions if they choose to leave the government service. According to the new circular, there won’t be any impact on both these both sensitive areas.

In addition to this, a committee has been appointed to find out if five years of leave could be granted to government employees to work in the private sector. The committee is expected to submit its report to the cabinet within the two weeks, the government official said.

“There is no way we can go ahead with the current public sector. The ideal size is 500,000. But it is an ambitious target and there could be a lot of socio-economic impact if we are going to implement that in the short term,” the official said. (Colombo/Jun24/2022)

Indian shipment of rice, milk powder, medicines worth 3bn arrive in...

ECONOMYNEXT – A 15,000-metric ton shipment of rice, milk powder and essential medicines worth over three billion Sri Lankan rupees arrived in Colombo as part of a Indian humanitarian aid package to cash-strapped Sri Lanka as the island nation goes through its worst ever forex crisis.

The Indian High Commission in Sri Lanka tweeted Friday June 24 afternoon that more aid will follow.

From the people of #India to the people of #SriLanka!!! High Commissioner,Hon'ble Ministers @Keheliya_R, Nalin Fernando, MPs, various dignitaries and officials welcomed a large humanitarian consignment worth more than SLR 3 billion from #Tuticorn today. (1/2) pic.twitter.com/pMOF8kJppx

— India in Sri Lanka (@IndiainSL) June 24, 2022

This is the second such shipment to arrive from Tamil Nadu, India, since Sri Lanka defaulted on foreign debt as the country’s foreign reserves depleted making it difficult to pay for imports including essentials.

Related:

Indian shipment of rice, milk powder, medicines worth 2bn arrive in Sri Lanka

Friday’s donation, worth over 8.3 million US dollars, was ceremoniously handed over to Health Minister Keheliya Rambukwella, Minister of Trade, Commerce and Food Security Nalin Fernando and other officials.

Indian media reported that the shipment had set off from Tuticorin on Wednesday June 22.

The Tamil Nadu state assembly passed a resolution on April 29 to provide assistance to Sri Lanka. The Times of India reported that the Tamil Nadu government has promised total aid worth over 15.7 million US dollars. (Colombo/Jun24/2022)

Sri Lanka monetary meltdown: Steve Hanke on currency boards and flawed...

ECONOMYNEXT – Sri Lanka is now suffering the worst currency crisis in history of the island’s soft-pegged central bank which was set up in 1950 abolishing a currency board, dooming the country into exchange and trade controls as well as trade and exchange controls.

Emerging market central banks are notorious for the economic instability they frequently cause. For instance, Sri Lanka has had 16 IMF programmes and is discussing the next one. Only Pakistan has gone to the Fund more times in this region. In the past decade, the incidence of balance of payments crises in Sri Lanka has accelerated. Activist monetary policy or governments that spend beyond their means are often the reason for monetary instability in emerging markets.

Steve H. Hanke, Professor of Applied Economics at Johns Hopkins University, Baltimore, is a proponent of currency boards as a way to reign in irresponsible sovereigns. He is responsible for designing and implementing them in Estonia (1992), Lithuania (1994), Bulgaria (1997), and Bosnia and Herzegovina (1997).

He is also proponent of a close cousin to currency boards, “dollarization.” He is responsible for designing and implementing dollarization in Montenegro (1999) and Ecuador (2000). Hanke is also a senior fellow and Director of the Troubled Currencies Project at the Cato Institute in Washington, DC. Professor Hanke is known for his work as a currency reformer in emerging-market countries. In addition, he’s known as a currency and commodity trader. In 1995, when he was President of Toronto Trust Argentina in Buenos Aires, that fund was the world’s best performer.

He was a senior economist with President Ronald Reagan’s Council of Economic Advisers from 1981 to 1982 and has advised heads of state and governments in Asia, South America, Europe, and the Middle East.

In an interview with Echelon, Prof Hanke discussed why emerging economies often get into currency crises, how a currency board addresses the fundamental issues and if such reform is suitable in the midst of a balance of payments crisis.

There’s a lot of confusion whenever the word currency board is mentioned. Most people living in this century believe that currency depreciation is inevitable because, in their lifetimes, they have not seen fixed exchange rates. Can you explain to us what a currency board is and what a floating exchange rate is and why they are both consistent regimes that do not collapse suddenly?

There are two types of exchange rates that are consistent with free-market principles. One is the floating exchange rate. In that case, the central bank has a monetary policy, but it does not have an exchange rate policy, the exchange rate moves around freely, and that’s why it’s called “floating”.

In that case, you don’t experience a balance of payments problem, because there’s no conflict between monetary policy and exchange rate policy as the currency is floating. You have a monetary policy, but don’t have an exchange rate policy so there can’t be a conflict.

The big problem with a floating exchange rate is that you have no imposition of a hard budget constraint on the fiscal authorities. In other words, the central bank has its monetary policy and one thing it can do is loan money to the fiscal authorities by printing money and creating credit.

What would happen if you had a floating exchange rate in Sri Lanka? The rupee wouldn’t float on a sea of tranquility, it would sink like a stone. That’s the big problem.

Now, let us move to the fixed exchange rate. The typical monetary institution that imposes a fixed exchange rate is what is called the currency board system. Ceylon, as your country was once known, actually had a currency board for about 70 years from 1884 until 1950. The Ceylon rupee was fixed to the Indian silver rupee at a fixed exchange rate.

Fast forward.What would happen to the rupee if it was issued by a currency board? It would become a clone of whatever the anchor currency happens to be. For example, the U.S. dollar.

If you had a currency board, and you had a fixed exchange rate for the Sri Lankan rupee with the US dollar, and it was backed 100% with US dollar reserves, the rupee would be the same thing as the U.S dollar. If you didn’t like the rupee, you’d take it into the currency board and exchange it at the fixed exchange rate and receive your U.S dollars at that fixed exchange rate. That would be the end of it. In effect you would be indifferent to the Sri Lankan rupee or the U.S dollar; they would be the same thing. In fact, it would technically be the equivalent of dollarizing and getting rid of the rupee. But if you want the rupee, you have a fixed exchange rate with a currency board. That’s what happens.

Now, a currency board is another free-market mechanism for the balance of payments. With a currency board, you have no monetary policy, but you do have an exchange rate policy. So, you can’t have a conflict between the two, you never get your feet tangled up, you never have a balance of payments eruption or anything like that. You don’t have the kind of problem that you have right now in Sri Lanka.

The exchange rate system that you have in Sri Lanka is what’s called a pegged exchange rate system.These systems actually contain a number of types, including “managed floating,” “pegged but adjustable,” “crawling pegs,” and so on.In a pegged system the central bank has a monetary policy, but it also has an exchange rate policy and those two invariably end up in conflict and a balance of payments crisis erupts as a result of that.Most developing countries have pegged exchange rate systems, and that is precisely why they invariably end up with a balance of payments crisis on their hands.

The beauty of the fixed exchange rate system, or a currency board,is that it provides discipline to the fiscal authorities because the currency board cannot extend credit to the fiscal authorities. So, there’s a hard budget constraint. And the reason they can’t, is that if the fiscal authorities wanted to receive more rupees, they would have to go to the currency board and give the currency board U.S dollars in exchange. So, there’s no creation of credit under that system.

What you find in currency board countries is that you not only have the advantage of this smooth, free-market mechanism for adjusting the balance of payments, but you also have a hard budget constraint put into the system. It’s like a straitjacket around the fiscal authority. So what you’ve witnessed – the wild spending and so forth in Sri Lanka – that couldn’t happen with a currency board, because the fiscal authorities would be in a straitjacket and so would the monetary authorities, because remember I said that with a currency board you have no monetary policy. No discretionary monetary policy.

Is there a connection between dollarization and currency boards? Are we talking about the same thing here?

A currency board is exactly the same as dollarization in the sense that the adjustment process is the same and stability is the same because you have no conflict between monetary policy and exchange rate policy. With dollarization, you have no monetary policy and no exchange rate policy because you have no local currency. And you have no exchange rate policy because you don’t even have a local currency. So, the dynamics of currency boards and dollarization are actually the same.

The only difference is with a currency board you have a local currency point number one, and point number two, you earn seigniorage or a profit off that because you’re issuing the currency from the currency board, that’s a liability, that pays no interest and the reserves that you’re backing that currency with 100%, are invested and earning interest. So you always have a profit being generated by the currency board.

Most people here believe trade deficits drive the value of the currency. But we know that some countries, for instance, the US have chronic trade deficits, but have strong currencies?

First of all, there is a great deal of misunderstanding and ignorance about what causes a trade deficit. Trade deficits are not caused by exchange rates, they are not caused by nefarious activities by foreign countries, unfair trade, and that kind of thing. Trade deficits are homegrown. The trade deficit in Sri Lanka is caused by the fact that savings are deficient relative to investment. This is what’s called an accounting identity, savings must equal investment, and if savings are less than the investment, that difference is made up by the trade deficit.

In Japan, for example, you have a trade surplus, because it has huge excess savings in the economy, relative to investment in Japan, and you have a huge trade surplus and an export of capital. They’re not borrowing from anyone, they’re lendingtheir surplus savings to foreigners. You have the same thing going on in China. Just like Japan, China saves much more than it invests, and it exports this excess savings. And also associated with that savings surplus, relative to investment, it has a trade surplus. Most people just don’t understand the dynamics associated with the savings-investment identity and the fact that trade deficits and surpluses are all homegrown.

Let’s talk about the experience of some countries with currency boards. Argentina is pointed out sometimes. A lot of people claim that Argentina had a currency board. What are your thoughts on that? What actually happened there?

Well, you’re talking about a country that I know a lot about because I was President [Carlos] Menem’s advisor. He was elected in 1989, and when I first met President Menem, Argentina had triple-digit inflation and had just come out of hyperinflation. He was trying to liberalize the economy and more or less follow the same kind of model that the Chicago Boys had introduced in Chile a few years before. He wasn’t getting anywhere with the reform and he asked me what the problem was. He couldn’t privatize anything and couldn’t liberalize anything. Nothing was happening.

And I said, unless he killed inflation, he would not have any credibility, and he would not be able to do anything. And he asked, ‘How do you do that? How do you kill inflation?’

I said, ‘What you want to do is do what you did in the 19th century, in Argentina, when you put in a currency board and backed it with the anchor currency, like the US dollar. So the peso would become a clone of the dollar because the peso would trade at a fixed exchange rate with the dollar and be backed 100% with dollar reserves, and everything would be fixed.

He asked me whether I could write that up.So, Dr. Kurt Schuler and I wrote a monograph, titled Banco Central o Caja de Conversión?, that was published in Buenos Aires.It laid out the architecture for an Argentinec urrency board. Menem liked it. But when they got into structuring the law, in April of 1991, they introduced something they called “Convertibility”. As it turns out, the Convertibility System looked somewhat like a currency board, because it required a fixed exchange rate and high levels of foreign exchange reserves. But, the Convertibility Law contained many loopholes which allowed for discretion on the part of the monetary authorities. In short, it allowed the monetary authorities to engage in a monetary policy and simultaneously an exchange rate policy. That’s a “no-no” with a currency board.

Convertibility did kill inflation immediately and the economy started booming. And Menem got tremendous credibility and started engaging in a lot of other successful free-market reforms. So that was the initial impact.

But also, September or October 1991, I wrote an article published in the Wall Street Journal, titled Argentina Should Abolish Its Central Bank. I said Argentina should transform Convertibility into a currency board system. I said, if they don’t, eventually this thing will blow up and they’ll have problems. The reason I said that is that the Convertibility System actually allowed for the two things that I told you are associated with a pegged exchange rate system.

That is, the central bank could have a monetary policy, a discretionary monetary policy, and at the same time, have an exchange rate policy. Eventually, you can get yourself into trouble due to conflicts between a monetary and exchange rate policy.

It happened in 2001, 10 years after the introduction of Convertibility. Convertibility did blow up. The system operated very well for 10 years. Inflation was almost the same as in the United States, the economy boomed and contrary to what most people think, the economy remained competitive, and the export sector remained robust throughout that period.

But if you look at 1999-2001, during that period, when they were deviating from currency board rules, because they were a Convertibility System, there was a lot of debating about the system itself.

And Kurt Schuler did a survey at that time to see how the top 100 economists in the world were referring to the Convertibility System. 93 out of the 100 were incorrectly referring to Convertibility as a currency board.

And this is a very technical thing. If you look at the balance sheet of a real currency board, there’s only one thing on the asset side of the balance sheet that moves around and that’s the foreign exchange reserves. You have no domestic assets. And if you do, they’re frozen and not moving around.

In Argentina, they had the foreign reserves on the asset side of the balance sheet, but they also had net domestic assets. Those net domestic assets were moving all over the place. They were buying, selling and sterilizing the inflows of foreign exchange coming in and neutralizing the outflows. The foreign exchange component was moving around, but also the net domestic assets were moving around. And you can’t have this with a currency board.

It’s a technical thing, most economists don’t understand it. Convertibility was, in fact, a pegged exchange rate system with a very high level of reserves. So, it had a lot more credibility than most pegged systems because, for most of its life, it had big reserves over 100% of the pesos outstanding.

Let’s talk about Sri Lanka’s circumstances and perhaps draw some parallels with the work you’ve done in Eastern Europe. Sri Lanka is in a crisis. You have set up currency boards in countries in crises. What can we learn from that experience? Is a currency board something you can set up during a crisis?

I’ve set up four currency boards during crises of one sort or another. The first one was in Estonia in 1992. Estonia had just gained its independence from the Soviet Union. At that time, they didn’t even have a post-Soviet constitution. And in June of 1992, we set up a currency board and we got rid of the Ruble. The Russian Ruble was the currency. We got rid of that and introduced the Estonian Kroon, and it worked perfectly. And by the way, the important thing there was that we set that up in less than 30 days. From the time I introduced the idea, until the time it was implemented it was less than 30 days. It worked perfectly. It smashed inflation right away, Estonia got a local currency and stability was established.

And while stability might not be everything; everything is nothing without stability. So that was Estonia. The IMF, by the way, gave it rave reviews. All of the IMF’s Article IV reports that came after June of 1992 were very positive.The currency board was very successful.

Then, in 1994, PM Slezevicius brought me into Lithuania and I became part of the government, where I operated as a state councilor. We put in a currency board in 1994, mainly because PM Slezevicius wanted a hard budget constraint in the system. He wanted to put the central bank into a straitjacket so that it couldn’t extend credit to the fiscal authorities. He wanted to discipline the system.

The main purpose when it came to Estonia was to get rid of the Russian Ruble and establish its own currency. In Lithuania, the main purpose was to impose a hard budget constraint on the fiscal authorities.

Then in Bulgaria, I was President Petar Stoyanov’s’ chief advisor in 1997 and they had hyperinflation at that time. The inflation rate peaked at 242% per month.

We implemented the currency board in July of 1997. It then smashed the hyperinflation and put discipline into the system. The banking system had been insolvent before that. By the end of 1998, it was all solvent. And, by the end of 1998, money market rates had plunged to 2.4% per year.

Back then, the Deutsche Mark was the anchor currency for the Bulgarian Lev. And the Bulgarian Lev was trading at a fixed exchange rate with the Deutsche Mark with reserves of 100% of the Lev being emitted.

Bulgaria still has a currency board. It has the second-lowest debt to GDP ratio of any country in the European Union. And that’s because of the hard budget constraint. The central bank that operates as a currency board cannot extend credit to the fiscal authority. So, no matter what government is in power, the budgets are more or less balanced in Bulgaria.

The last currency boardI was involved in establishing was in Bosnia and Herzegovina in1997. It was put in right after the civil wars in Yugoslavia and it was mandated by the Dayton Peace Accords. Those accords mandated that Bosnia and Herzegovina must install a currency board.

So, all four of these, with perhaps the exception of Lithuania, were installed during hot crises, and all worked extremely well. Indeed,they have all consistently received rave reviews by the IMF over the years. And in Bosnia, the situation was very tense, because you were right in the middle of a civil war situation.

How do you go around finding the capital for a currency board? I’m curious how these four European countries that you refer to did it also. And what will happen to the existing reserve money and the bank deposits in the banking system? Can they exist in parallel? What happens?

These countries didn’t have problems with reserves, because the real inflation-adjusted value for their local currencies that were inflating at the time was very small. So, the reserve requirements, given the fixed exchange rate, determine the fair value of the currency, and you fix the exchange rate. Then you determine how many reserves you need. They needed very small reserves in these cases because the real value of the money supply was small. So, the reserves were not a problem whatsoever. They had plenty of reserves, in all cases.

Even Estonia, right after they left the Soviet Union, had gold reserves that had been shipped during World War Two. They had sent their gold reserves to London. So, they actually had gold reserves, waiting in London, that were used to back up the new currency that was started.

You can obtain the reserves in several ways. Number one, you can borrow the money.

Let’s say you had zero reserves to set up a currency board. You could borrow those reserves from the government and if your currency is backed 100% the currency board could easily pay off the borrowings because they would be making a profit every year. That would be one way.

Or there have been currency boards that have started with less than 100% reserve cover for the total emission that is outstanding. But, the marginal or incremental issue of currency could not be made unless it was backed 100%. The infra-marginal could be conceivably less than 100%. But the marginal would always be 100%. These are technical things, but they haven’t posed a problem.

You asked, how have these performed? There have been over 70 currency boards in existence and none have ever failed. There’s never been a failure. And the ones that I gave you are the four new ones, Estonia, Lithuania, Bulgaria and Bosnia and Herzegovina. If you look at the IMF reports after we installed them, they are glowing. The IMF can’t say enough good things about the stability and the discipline that was put into the economy with a currency board.

Are there any preconditions in your view, to setting up a currency board?

This is another stupidity economists talk about. Many economists claim that there are all sorts of preconditions that must exist before a currency board can be installed. In short, they stupidly assert that a state of bliss must occur before you install a currency board.

In fact, there are no preconditions for the installation of a currency board.That’s not the point. You want to put in a currency board when everything is bad. Look at Estonia and Bulgaria, were there any preconditions? There were zero preconditions. Look at Bosnia, in the middle of a civil war, with no preconditions, none whatsoever. Everything was a complete disaster until a currency board was established, rapidly, in all cases.

And the solution to the major problem of inflation and the balance of payments problem was fixed immediately.

Look at it this way. Why do you have a balance of payments problem? What’s one of the biggest causes of the problem in Sri Lanka? It’s the fiscal deficit. That’s where it comes from.

When the new government came in, the Central Bank of Sri Lanka was the first in the world to adopt what is called Modern Monetary Theory. The government said, well, where are you going to get the money? And the central bank said it’s not a problem, we’ll print it. It’s an almost delusional statement of complete incompetence. But there you go, that was the road that was taken in Sri Lanka and it was the road to hell.

And the question is, how do you redeem yourself and remove yourself from hell. There is only one way and that’s a currency board. This idea that some of the IMF people are suggesting about a floating exchange rate is wrong. The rupee will not float on a sea of tranquility; it will sink like a stone.

And what the IMF foolishly says is you’ll have discipline because the IMF will manage things from Washington DC. No. You manage things in Sri Lanka with a currency board, you fix the problem yourself. This is a local problem and it can only be fixed by locals. And the only way to fix it is to put the government in a straitjacket with a currency board.

This happened in Bulgaria. It’s fixed. They have the second-lowest debt to GDP ratio of any country in the European Union. Before the currency board, they had defaulted on their foreign debt twice since they were independent, in the post-communist era. They even defaulted on their domestic debt as well.

Literally within days, the inflation was smashed, and within months, Bulgaria’s bank solvency problem was fixed, and the sovereign debt problem was fixed within months also.

How does a country default on its domestic debt? You can always print the money?

What if they don’t? It is unusual to have domestic debt default rather than a sovereign foreign debt default. But it does happen sometimes. The government just didn’t pay the bondholders.

There are regimes which seem to have stable exchange rates for decades. For instance, GCC countries have fixed exchange rates. China has had a fixed exchange rate for decades. And it appreciated as soon as it broke it. How do you explain this?

The Gulf countries do not have currency boards. Their monetary systems aren’t orthodox currency boards, in any case, but kind of quasi-currency boards.But their systems have been very reliable fixed exchange rate regimes because they operate them in a de-facto currency board manner. But, unlike currency boards,these systems are vulnerable and can blow up.

In 1986 when I was doing a lot of foreign exchange trading at that time, and trading oil at the Friedberg Mercantile Group in Toronto, where I was the chief economist at the time – now I’m the Chairman Emeritus of the Friedberg Mercantile Group – we detected that OPEC was going to collapse in early 1986 and we predicted precisely that the price of oil would go below $10 a barrel. And we also anticipated that this would cause big problems in the Gulf and with the pegs that they had; we predicted that their pegged exchange rates would blow up.

We shorted oil with huge positions.Indeed, we had 70% of all the short interest in London. We also were shortthe Kuwait Dinar and the Saudi Riyal and, sure enough, both of those were devalued in 1986. Since then, they’ve been fixed.

Unless you have a major collapse in oil prices, for example, those quasi-currency boards and pegs that they have are pegged systems. They do have a monetary policy and an exchange rate policy. The exchange rate is fixed, but they have some monetary policy.

In Sri Lanka the central bank’s net foreign assets are negative, and the monetary base is about 1.3 trillion, which is about $5 billion. But the central bank has dollar-denominated debts of about $5 billion. So, in that case what do we do? Do we need a new currency board?

What we did with Estonia, Lithuania, Bulgaria, Bosnia and Herzegovina, is we retained the central bank. But we changed the central bank law to make what they call the issue department, a currency board. So, you have a currency board inside the central banks in those countries.

Now, what you could do is set up a new monetary authority, a new currency board from scratch, and that would be esy to do, because currency boards only require a handful of people to run them. You’d probably only need a staff of about six to ten at most to run a currency board.

So, one thing you’re suggesting is that the central bank is in such a financial mess in Sri Lanka, that maybe it would be a cleaner operation, instead of changing the central bank law and transforming the central bank into a currency board, to actually set up a new entity.

Your question suggests that there might be a cleaner way, andthat way to fix this mess up with a currency board organized as a new, separate entity.

Then what happens to the reserve money and what happens to the bank deposits and the banks that are linked to the old money? Do you have two currencies operating?

No, you would have only one currency, which is the new one that would trade at a fixed exchange rate with the anchor currency and be backed 100% with anchor currency reserves. That would be the way I would do it. In currency and monetary affairs, you keep things as simple as you possibly can.

There have been countries where there have been parallel currencies, but I would avoid those kinds of complications. I like to keep things simple. If you keep things simple, they usually don’t break.

What happens to deposits. The banks are in trouble now?

Well,the banks were in trouble in Bulgaria. They were insolvent. The banks will get out of trouble if you get the economy going. Then if the economy grows the debtors can pay off the creditors. In one year in Bulgaria, we made an insolvent banking system solvent and the level of foreign exchange reserves tripled. The reservestripled in 12 months.

The reason for that is that there is a huge arbitrage profit to be had once you put in a currency board. Because if you did, the Sri Lankan rupee interest rates would be higher when you first started than interest rates in the United States. So, it would pay me to borrow money or take my dollars and exchange them for Sri Lankan rupees because I could earn a profit, a risk-free profit. And that’s exactly what happened in Bulgaria and that’s what happened in every one of the newcurrency boards that I established.You have huge arbitrage going on initially so you get a big capital flow coming into the currency board. With a currency board in Sri Lanka, the foreign exchange reserves would go up very fast because of the increased demand for the new solid rupee, which would be a clone of the US dollar. Indeed, the demand for those rupees would be very high.

And the reason that they’re high is that the interest rate, initially, will be higher in the rupee than in the US dollar. Now, that’ll arbitrage down and the interest rates will equilibrate. They’ll be identical on a risk-adjusted basis.

You’ve been an associate of Milton Friedman and have called him your mentor. What was his opinion about currency boards?

Milton Friedman is mainly known for being an advocate of flexible or floating exchange rates. That’s what most people think.

Friedman was for free market mechanisms to adjust the balance of payments, and there are two ways to do that. You either have a floating exchange rate, or you have a fixed exchange rate with a currency board. In Hong Kong in 1983, when they put the currency board back in, John Greenwood was the architect of that and Milton Friedman was 100% behind it, he endorsed the thing.

In Estonia, Lars Jonung, Kurt Schuler and myself wrote a book titled Monetary Reform for A Free Estonia: A Currency Board Solution. It was published in Estonian and English. Who endorsed that book on its dust jacket? Milton Friedman. So, Friedman has always been for currency boards in developing countries and countries with weak institutions and unstable governments.

He knows that the hard budget constraint gets put into the system and the straitjacket gets put on the politicians, forcing them to more or less balance the budget if you have a currency board system.

So that’s where Professor Friedman was on that. It looks like a contradiction, but it’s perfectly consistent. Pure floating exchange rates and a fixed exchange rate with a currency board are identical in the sense that they are free-market mechanisms for adjustments in the balance of payments.

The floating exchange rate has a monetary policy but no exchange rate policy. The fixed rate delivered via a currency board has an exchange rate policy but no monetary policy.

You brought up John Greenwood. Last year you wrote an op-ed with John Greenwood in the Wall Street Journal about US inflation, which was spot on. Can you explain your association with John Greenwood?

John Greenwood and I go back quite a few years. Not quite as far back as 1983, when he designed the currency boardfor Hong Kong. There were three key people involved in that; we had Greenwood, the man on the ground, we had Milton Friedman, and also Sir Alan Walters. Now, Sir Alan Walters was Maggie Thatcher’s economic guru at 10 Downing Street, but he was also a professor at Johns Hopkins University where I’m a professor.

We were very close colleagues. We edited two books together. We wrote the entry for the currency boards in the New Palgrave Dictionary of Economics. So, Hong Kong’s 1983 experiment was via Alan Walters. Because remember, Thatcher was the one that put the green light on the thing. Hong Kong was a colony. So, the PM at 10 Downing Street was the one who had to say yes. And Thatcher did on the advice of Sir Alan Walters. And Sir Alan, who was a close friend of mine, was keeping me informed. That’s where I was introduced to currency boards.

Subsequently, Greenwood has had a number of my students as interns of his in Hong Kong.For example, Dr. Kurt Schuler was an intern of John Greenwood’s. And Dr. Kurt Schuler was a postdoctoral fellow of mine, a student of mine.

Dr. Chris Culp was also an intern there, he was a student of mine. Then Greenwood and I were personally introduced when we were part of Robert Mundell’s, the Nobel Laureate, inner circle,where we would meet every year in Tuscany, at the Mundell Palazzo. One thing led to another, and Greenwood is now actually a fellow at the Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise. So, he lives in London, but he’s a fellow at my Institute at Johns Hopkins.

How did you get on with Robert Mundell?

Mundell was a big backer of currency boards and fixed exchange rates. We served on the financial advisory board together in the United Arab Emirates for several years. So, we actually had an official position together. In addition to being quite good personal friends, and professional colleagues, we were literally working together in the United Arab Emirates.

I could remember the first meeting we had at the financial advisory council was the week after Lehman Brothers went bankrupt, in the great financial crisis of 2008.We were in Dubai at the time. We had a lot on our plate immediately. The first meeting was very intense.

And the one thing about the UAE is they can act very fast. So, we made big recommendations to the Minister of Finance. And that was the last day of our meeting when we made our recommendations. We flew out that night and when I landed in Washington D.C., they’d already implemented all the policy changes that we’d recommended. They don’t waste time.

Sri Lanka stocks gain for third day amid worst foreign outflow...

ECONOMYNEXT – Sri Lanka stocks closed higher for a third straight session on Thursday (23), led by Expolanka shares and new buying interest in some banking shares, but witnessed the worst foreign outflow in three weeks.

Foreign investors sold a net of 163 million rupees worth of shares on Thursday, its worst since June 2. The market has witnessed a total foreign outflow of more than 1.2 billion rupees so far this year.

The main All Share Price Index (ASPI) closed 0.58 or 43.94 points higher at 7,556.09. It has gained 1.8 percent in the last three sessions.

“The market mainly moved on Expolanka’s cash dividend announcement. However, there was buying interest coming in to the banking sector as those shares have bottomed out a lot,” a market analyst said.

The turnover was 1.1 billion rupees, highest since June 17, but still less than a third of this year’s daily average turnover of 3.53 billion rupees.

Analyst previously said theres a lot of selling pressure in the market because the investors do not see an ideal market at least for the next 9-months due to high interest rates and taxes.

A 10-member IMF team arrived in Sri Lanka and began discussions on policy corrections with Prime Minister Ranil Wickremesinghe on Monday and the talks have been seen as positive for the investor sentiment. However, Sri Lanka must show progress on debt restructuring before IMF lends any money.

Market analysts have said investors were heavily feeling the pinch of economic crisis as the country’s fuel bunkers have dried out the island nation was frantically looking for dollars to purchase fuel.

The public sector and the schools have moved online for two weeks on the government’s advice to reduce transport and save fuel.

Though a new prime minister and a new cabinet have been appointed, analysts see little progress on both the economical and political fronts. The country is struggling to ensure a continuous supply of fuel due to a shortage of US dollars.

The more liquid S&P SL20 index gained 0.9% or 21.63 points to 2,431.44

The market has so far lost 6.7% in June after gaining 6% in May. It lost 23% in April followed by a 14.5% fall in March.

The market has lost 38.1% so far this year after being one of the world’s best stock markets with an 80% return last year when large volumes of money were printed.

Sri Lanka’s sovereign debt default has already led the country to be rated with restricted/selective default rating by rating agencies, which has weighed on investor sentiment.

Investors are also concerned over the steep fall of the rupee from 203 to 370 levels so far in 2022.

Expolanka Holdings gained 7.8% to 185.75 rupees a share, a day after it announced a 8 rupees cash dividend.

Browns Investment was up 5% to 8.4 rupees a share, while Hatton National Bank gained 3% to 80 rupees a share. (Colombo/June 23/2022)

Indian delegation meets President, PM; discusses economic crisis

ECONOMYNEXT – A high-level Indian delegation led by Foreign Secretary Vinay Kwatra met Sri Lanka President Gotabaya Rajapaksa and Prime Minister Ranil Wickremasinghe for discussions kn promoting bilateral investment in the fields of infrastructure, connectivity, renewable energy and deepening economic linkages, the Indian High Commission said.

Sri Lanka has sought more loans from its neighbour to manage the island nation’s ongoing economic crisis which has led to the shortage of essentials like fuel, medicines, and cooking gas amid lengthy power cuts due to lack of US dollars.

The South Asian country already declared sovereign debt default on April 12.

The Indian delegation also included Shri Ajay Seth, Secretary, Department of Economic Affairs, V Anantha Nageswaran, Chief Economic Advisor and Kartik Pande, Joint Secretary, Indian Ocean Region at the Indian Ministry of External Affairs.

“Both sides had a productive exchange of views on the current economic situation in Sri Lanka as well as India’s ongoing support,” the Indian High Commission said referring to the delegation’s meeting with the president.

“In the meeting with Prime Minister Ranil Wickremansinghe, the two sides had an in-depth discussion on the Sri Lankan economy and efforts undertaken by the government of Sri Lanka towards achieving economic recovery.

“In this context, both sides highlighted the importance of promoting India-Sri Lanka investment partnership including in the fields of infrastructure, connectivity, renewable energy and deepening economic linkages between the two countries.”

Many Sri Lankans have welcomed Indian support cautiously due to past experiences.

Political analysts told EconomyNext the Indian rush for help has come at a time India and the West led by the United States are concerned about China’s strong presence in Sri Lanka.

China has become the top bilateral commercial lender to the island nation since the end of a 26-year war in 2009.

India has raised concerns over Chinese activity in Sri Lanka claiming that it could compromise the Indian Ocean’s security.

Sri Lanka had to cancel a renewable energy project given to a Chinese company in the northern islands due to Indian pressure citing security concerns, government officials have said.

A majority of Sri Lankans are still vary of Indian assistance because of its role in creating, backing and training the Liberation Tigers of Tamil Eelam (LTTE), a rebel group who fought for a separate state in Sri Lanka’s North and East for nearly 30 years.

However, later, India along with many other international partners helped Sri Lanka to wipe out the LTTE, which had killed Indian Prime Minister Rajiv Gandhi in 1991. (Colombo/Jun23/2022)

Sri Lankans express anger, frustration over president’s tweet after cricket win

ECONOMYNEXT – Hundreds of Sri Lankans, battered by the country’s worst ever forex crisis, took to Twitter to vent their frustration at President Gotabaya Rajapaksa this week when he tweeted a congratulatory message to the national cricket team which won a five-match cricket series against Australia.

A young Sri Lankan cricket team won the fourth game held in Colombo by just four runs to secure a series win after conquering the five-time world champions.

“Congratulations to Sri Lanka cricket team on the win against Australia in the one day series. The sportsmanship shown by the Sri Lankan team has been remarkable. People of Sri Lanka are also grateful for the support given by Cricket Australia to overcome the economic challenges in Sri Lanka,” Rajapaksa tweeted.

Congratulations to #lka cricket team on the win against #Australia in the one day series. The sportsmanship shown by the #SriLankan team has been remarkable. People of #lka are also grateful for the support given by @CricketAus to overcome the economic challenges in . #AUSvsSL

— Gotabaya Rajapaksa (@GotabayaR) June 21, 2022

Sri Lankans, who have been going pillar to post to feed their families and ensure essentials like fuel, cooking gas, medicines, food, and milk powder amid lengthy power cuts, took their frustration out on the president who had just turned 73 a few days prior.

It was the first time Sri Lanka had won a series against mighty Australia in 30 years.

Many Sri Lankans see Rajapaksa and his family as responsible for the current economic crisis. Thousands of young, nonpartisan protesters have been demanding Rajapaksa’s resignation for 76 days as of Thursday July 23 near the presidential secretariat in Colombo. Over this period, Sri Lanka saw a change in prime ministers as well as the resignation of the entire cabinet twice over.

However, Rajapaksa has said he cannot leave as a “failed president” and has vowed see his term to its completion in November 2025.

“You obviously never played any sport. That is why you do not know how to accept defeat. You are a failed President. Please GO,” responded one Twitter user.

You obviously never played any sport. That is why you do not know how to accept defeat.

You are a failed President. Please GO

— Shiran de Soysa (@deSoysaShiran) June 21, 2022

“At least learn from cricket how to make way for someone more capable than you,” another tweep said.

තමාට හැකියාව නැති උනාම සුදුසු කෙනෙක්ට අවස්ථාව දෙන එක ක්රිකට් වලින්වත් ඉගන ගන්න මහත්තයා!

— Dil Sudarshana (@DileeSudarshana) June 22, 2022

“Please resign and make this moment even better to give some relief to the grievances of the nation,” said another.

Please resign and make this moment even better to give some relief to the grievances of the nation. #EconomicCrisisLK #Lka

— Nuzrad Mohamed (@BeingNuzrad) June 21, 2022

Some of the tweeps used abusive language in response to the president’s congratulatory tweet, and many demanded that he step down due what they called his abject failure.

“No. This is victory for the cricket team. Your dismissal is the real victory for all Sri Lankans,” said one tweet.

“Please Mr President keep out of this. The SL cricket team is the only entertainment and [source of] pride we are left with,” said another.

“How can the Australian cricket team help to overcome economic challenges? Did they bring dollars in the plane? Pls don’t take credit for our team’s win,” another tweeted.

Some more tweets are reproduced below:

“Dont think people will be delusional with this win and forget to remind you about the most important message…..” GOTAGOHOME”

“Namal went, Cricket prospered You go, Watch how the country will prosper.”

“A young team of cricketers put us back on the winning streak. Please handover the reigns to a team that can win – we as a country need to rejoice and winning back our lives we had.”

“Please don’t try to get involved in this [and] screw this one up too. Just let it be the way it is. You are NOT needed.”

One Twitter user had used crossed out images of President Rajapaksa, current Prime Minister Ranil Wickremesinghe, former prime minister Mahinda Rajapaksa and former finance minister Basil Rajapaksa with the line: “There is no point of cultivating without removing weeds”.

— jrod (@jrodbremen) June 22, 2022

Thousands of Sri Lankans started spontaneous protests over the looming economic crisis early in March when Rajapaksa’s government started to impose power cuts and struggled to import fuel and cooking gas due to a crippling dollar shortage – a shortage that experts have blamed directly on ill-advised policies of the government.

Rajapaksa is also blamed for his disastrous ban on chemical (inorganic) fertilizer without providing any alternative to farmers. As a results, the country has seen record high food prices due to a shortfall in farmland produce and lack of fuel to transport agricultural commodities.

The president also appointed himself as the Defence and Digital Technology Minister and appointed his elder brother Mahinda as Prime Minister. His oldest brother Chamal was made Minister of Irrigation while younger brother Basil became Finance Minister. His nephew and Mahinda’s son Namal, meanwhile, was appointed Youth and Sports Minister, while another nephew Shasheendra Rajapaksa, son of Chamal, was named deputy agriculture minister.

The powerful political dynasty controlled the country through the ruling Sri Lanka Podujana Peramuna (SLPP) even as the economic crisis turned into a full blown political crisis by early April. Since then, Rajapaksa was forced to remove his family members from key position due to strong protests by the public.

Prime Minister Mahinda Rajapaksa resigned after his supporters brutally attacked unarmed and peaceful protesters in Colombo on May 9. A court has ordered that he surrender his passport and police has questioned him over a meeting with his supporters held just before the attack. May 09 saw violent clashes, with over 70 ruling party members’ houses and assets either damaged or burnt.

The president later appointed Ranil Wickremesinghe as prime minister, but analysts say nothing has been done to supply essentials to the public with the crisis now getting worse.

Sri Lankan Twitter users had some choice words for their head of state.

“It’s time to go home”, “What do you know about sportsmanship”, “Devil, we are at fuel queues. It’s better if you go even now”, “Don’t screw up the little happiness the fans enjoy, pls leave”, and “OK, now you resign. Then it’ll be the perfect day” were among the responses that saw much engagement. (Colombo/Jun22/2022)

Sri Lanka petrol shipment delays by another day – Minister

ECONOMYNEXT – Sri Lanka’s petrol distribution is to be delayed by another day as a fuel ship carrying petrol has not reached the island’s shores, the power and Energy Minister said.

“Fuel cargo-carrying 40,000 MT of Petrol 92 scheduled to arrive early this morning has been delayed by 1 day,” Minister Kanchana Wijesekera said in a Tweet.

“Limited amount of Petrol to be distributed today (23) and tomorrow (24) islandwide.”

Therefore Petrol and Super Diesel to be in limited distribution while auto Diesel will be in full capacity island-wide, he said.

Fuel cargo carrying 40,000 MT of Petrol 92 scheduled to arrive early this monring has been delayed by 1 day. Limited amount of Petrol to be distributed today and Tomorrow islandwide. Auto Diesel distributed at full capacity islandwide. Limited distribution of Super Diesel.

— Kanchana Wijesekera (@kanchana_wij) June 23, 2022

Sri Lanka is going through the worst economic crisis in its 72-year history.

The country is struggling to find dollars to pay for its fuel supply in June while fuel queues tripled.

June fuel queues were seen to be worse than what it was in March when the forex crisis spilt over initially.

(Colombo/June23/2022)